The Illusion of Certainty in a Data Vacuum

The retail trading floor is currently high on a supply of cheap capital and the inertia of a Santa Claus rally. On this Wednesday, December 10, 2025, the Federal Reserve just delivered exactly what the algorithmic models demanded. A 25-basis point cut. The federal funds rate now sits at 3.50% to 3.75%. While the surface level news suggests a victory for the bulls, the internal mechanics of the FOMC vote reveal a fractured leadership that traders ignore at their peril.

This was not a unanimous decision. The 9-3 vote, featuring rare public dissent from governors who preferred a more aggressive 50-basis point slash, signals that the Fed is no longer reading from a single playbook. For those timing the market based on the assumption of a smooth landing, the reality is far more volatile. We are operating in the wake of a 43-day government shutdown that has effectively blinded the Bureau of Labor Statistics. The latest labor market figures are essentially educated guesses, as the lapse in appropriations during October and early November prevented the collection of primary survey data.

Apple and the Valuation Tightrope

Look at Apple (AAPL). Yesterday, December 9, 2025, Citigroup reiterated its buy rating with a price target of $330.00. On the same day, Wedbush pushed its target to $350.00. Yet, the stock is struggling to maintain its footing above $273. Why the disconnect? The answer lies in the information asymmetry created by the “Vision Pro 2” production rumors and the massive institutional rotation out of the Magnificent Seven and into gold, which just hit an all-time high of $4,585 per ounce. Per the latest institutional flow reports, the smart money is hedging against the very rate cuts the retail crowd is celebrating.

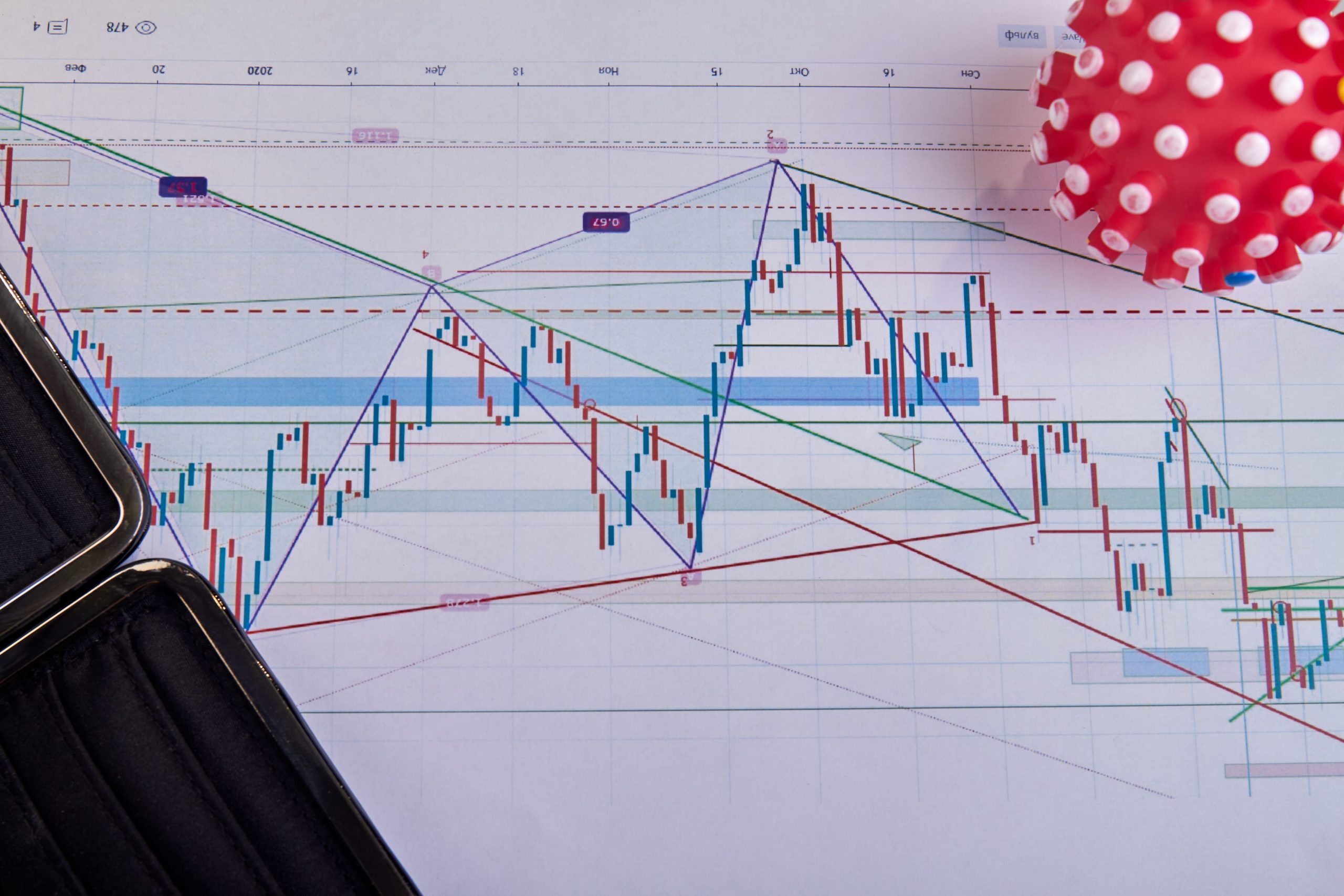

The Technical Failure of Timing Strategies

Traditional timing strategies rely on the Relative Strength Index (RSI) or moving averages to signal entry. In the current 2025 market, these are lagging indicators that lead to “liquidity traps.” When the S&P 500 crossed 6,900 this week, it did so on the lowest trading volume of the year. High-frequency trading (HFT) algorithms are front-running retail orders by milliseconds, exploiting the wide spreads caused by the recent volatility in the 10-year Treasury yield, which currently hovers at 4.13%.

If you are timing your exit based on the belief that rate cuts always drive equities higher, you are ignoring history. The current environment mirrors the summer of 2000. Valuations are at the 98th percentile of historical ranges. The price-to-earnings (P/E) ratio of the S&P 500 is knocking on the door of 40. This is not a market driven by fundamentals; it is a market driven by the fear of missing out (FOMO) on the final leg of the AI-monetization cycle.

Decoupling Data from Sentiment

The October CPI report was a non-event because it didn’t exist. The November report, scheduled for release on December 18, will likely show inflation at 2.7%. However, the core services index remains stubbornly high. This creates a divergence. While the Fed is cutting rates to prevent a labor market collapse, the “supercore” inflation remains elevated due to shelter and medical care costs. This is the definition of a policy error in the making.

| Asset Class | Dec 9, 2025 Price | 72-Hour Change | Implied Volatility |

|---|---|---|---|

| S&P 500 (SPX) | 6,909.79 | +0.85% | High |

| Apple (AAPL) | $273.15 | -1.20% | Extreme |

| Gold (XAU) | $4,585.00 | +2.40% | Moderate |

| Bitcoin (BTC) | $87,500.00 | -2.10% | High |

The Mechanism of the Next Correction

Financial timing is increasingly about understanding “Gamma Walls.” As the market reaches record highs, market makers are forced to buy more underlying stock to hedge their options positions. This creates an upward spiral until a catalyst breaks the momentum. On December 10, that catalyst is the uncertainty surrounding the leadership of the Fed itself. With legal battles over the potential firing of Fed Governor Lisa Cook reaching the Supreme Court, the market is pricing in a 2026 where the central bank’s independence is no longer guaranteed.

Smart traders are looking at the Form 4 filings from the last 48 hours. Corporate insiders at major tech firms are selling at a rate not seen since 2021. They aren’t timing the bottom; they are timing the exit before the tax year closes and the reality of 2.8% sticky inflation hits the Q1 earnings reports. The window for “safe” entry has closed. The current rally is a game of musical chairs where the music is being played by an AI that knows exactly when to stop.

Watch the January 13, 2026 release of the full December CPI data. This will be the first clean data set since the shutdown and the primary indicator of whether the Fed’s 3.5% target is a floor or a trap. If the core inflation figure prints above 3.1%, expect the S&P 6,900 support level to dissolve within 48 hours.