The monolith is cracking. Silicon Valley’s grip on the S&P 500 has finally loosened. Morningstar confirmed the structural decay this afternoon. The concentration that defined the last decade is evaporating. This is not a standard correction. It is a fundamental reordering of the capital markets. For years, the narrative was simple. You bought the biggest seven names and ignored the rest. That trade is now a liability. Institutional allocators are fleeing the top-heavy indices. They are seeking refuge in the neglected basements of the market.

The Math of the Reversal

The numbers do not lie. At the peak of the mania, the top ten stocks in the S&P 500 accounted for over 34 percent of the index’s total value. That figure has plummeted. According to Morningstar’s latest data, the tech-heavy concentration is going in reverse. We are seeing a mean reversion of historic proportions. The Herfindahl-Hirschman Index (HHI), a measure of market concentration, is flashing red. It suggests that the market is becoming more competitive and less dominated by a handful of monopolies. This is healthy for the long term. It is painful for the passive indexers who bought the top.

Crowded rooms lead to stampedes. When everyone owns the same five stocks, there is no one left to buy. The marginal buyer has disappeared. In the last 48 hours, we have seen a massive rotation into mid-cap value. The equal-weighted S&P 500 is outperforming its market-cap-weighted sibling by the widest margin since the post-dot-com era. This is a liquidity vacuum. As the giants lose momentum, the passive flows that once propelled them upward are now dragging them down. It is a mechanical feedback loop in reverse.

Visualizing the Concentration Collapse

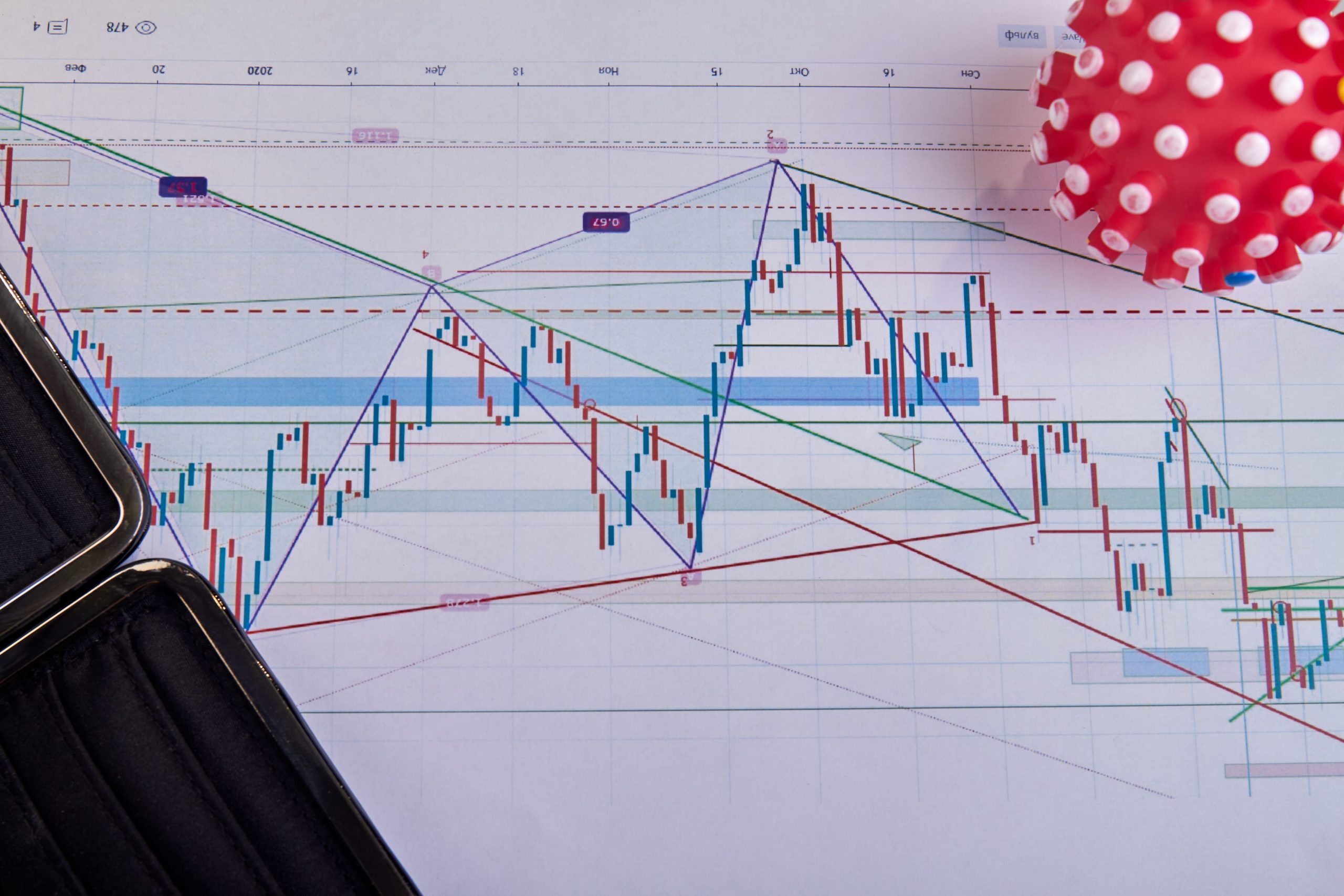

To understand the scale of this shift, we must look at the weighting distribution. The following chart illustrates the percentage of the S&P 500 held by the top ten constituents as of February 19, 2026, compared to the same period last year.

S&P 500 Top 10 Concentration Index (2025 vs 2026)

The Passive Momentum Decay

Passive investing is a momentum strategy in disguise. When a stock goes up, the index buys more of it. This works perfectly until it stops. We are now in the ‘stopping’ phase. Large-scale redemptions from tech-heavy ETFs are forcing sales of Nvidia, Microsoft, and Apple. These sales drive the price down. The lower price reduces the index weight. The index sells more. This is the dark side of the indexing revolution. Per reports from Reuters, the outflow from the top three tech ETFs has exceeded 40 billion dollars in the last month alone.

Valuations are the ultimate gravity. You cannot trade at 50 times earnings forever when growth is slowing. The AI hype has met the reality of the balance sheet. Companies are finding that implementing generative AI is expensive and the return on investment is slower than the consultants promised. The capital expenditure of the hyperscalers is unsustainable. The market is finally pricing in a reality where Big Tech is just… tech.

Sector Rotation Performance Matrix

The following table shows the divergence in performance over the last 90 days. Notice the massive gap between the former leaders and the new cyclical favorites.

| Sector / Index | 90-Day Return (%) | P/E Ratio (Current) |

|---|---|---|

| Technology (XLK) | -12.4 | 29.5 |

| Financials (XLF) | +8.2 | 14.1 |

| Industrials (XLI) | +11.5 | 18.3 |

| S&P 500 Equal Weight (RSP) | +6.1 | 16.8 |

| S&P 500 Market Cap (SPY) | -4.3 | 23.2 |

The Institutional Flight to Quality

Smart money moved months ago. Hedge fund positioning data shows a significant shift toward ‘old economy’ stocks. This is a flight to quality, but not the quality of the 2020s. We are talking about cash flow. We are talking about dividends. We are talking about companies that make physical things. The era of the ‘infinite growth’ multiple is over. The Federal Reserve’s refusal to cut rates as aggressively as the market hoped has been the catalyst. Higher for longer is a death sentence for high-multiple growth stocks.

The yield curve is also playing a role. As the curve steepens, banks and financial institutions become more attractive. This is reflected in the Bloomberg Terminal data showing a surge in regional bank deposits. The capital is leaving the cloud and entering the ground. It is a rotation from the virtual to the tangible. This is not just a trend. It is a structural pivot that will likely define the remainder of the year.

The next major milestone for this transition occurs on March 18. That is when the FOMC will release its updated dot plot. If the Fed maintains its hawkish stance, the pressure on Big Tech valuations will intensify. The market is currently pricing in a 65 percent chance of a hold. Any deviation from that will trigger the next leg of the unwinding. Watch the 10-year Treasury yield closely. If it stays above 4.5 percent, the rotation into value will accelerate. The era of concentration is dead. The era of breadth has begun.