Institutional Trust Meets the Liquidity Trap

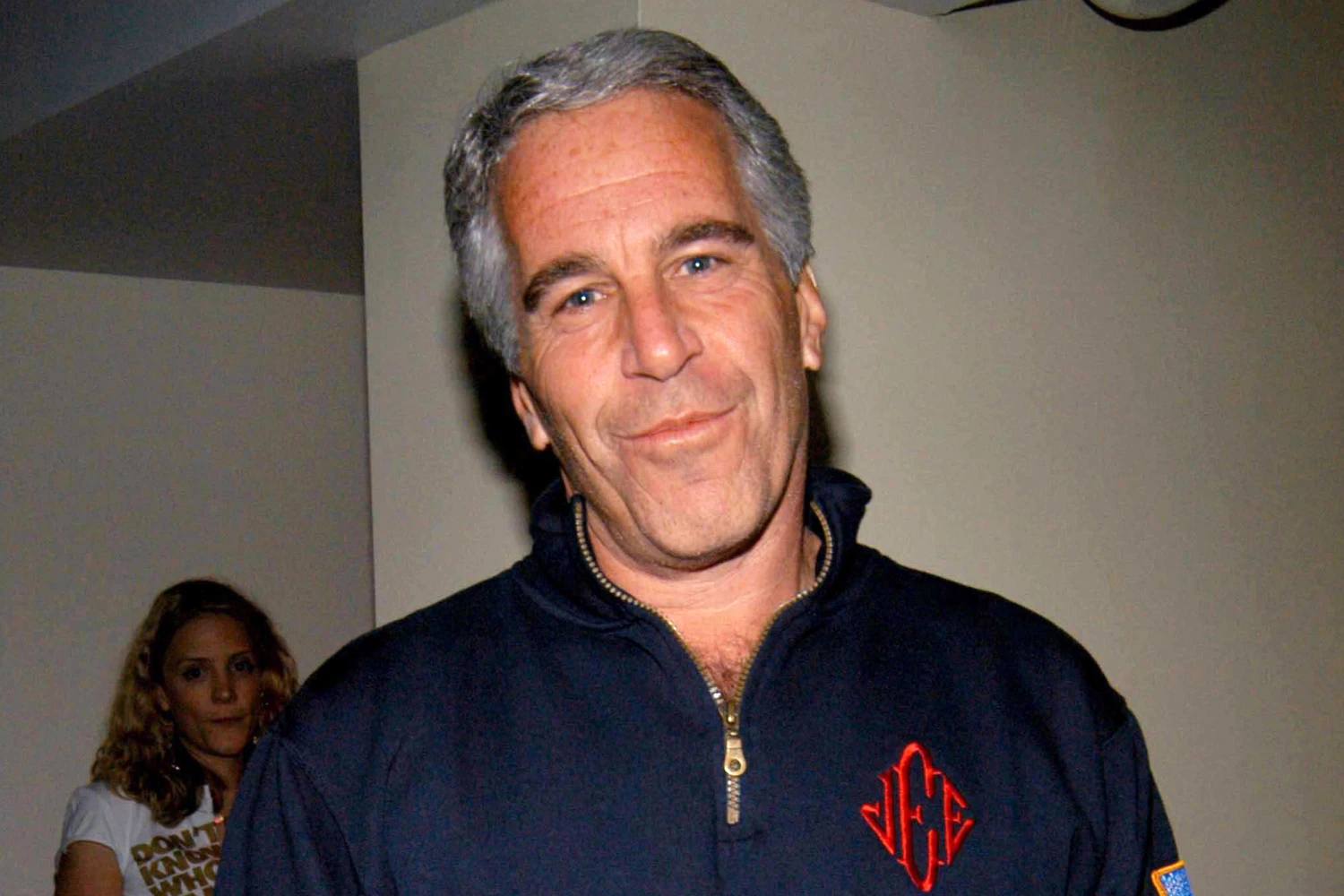

The files dropped. Markets buckled. This is not a drill. For years, the specter of the Epstein documents remained a tabloid fixture, a ghost in the machine of global power. Today, February 12, 2026, those ghosts have manifested as hard sell orders on trading desks from London to New York. The unsealing of the final batch of depositions has moved beyond social scandal. It has entered the realm of systemic institutional risk.

Sterling is the canary. It is gasping in the coal mine of institutional trust. As names of high-ranking UK officials circulate, the pound has faced its most aggressive sell-off since the 2022 mini-budget crisis. Investors are not just pricing in a scandal; they are pricing in a vacuum of leadership. When the executive branch of a major economy is paralyzed by legal and moral scrutiny, the currency reflects that paralysis through a steepening risk premium.

The Sterling Bleed and the Gilt Yield Spike

The City of London is currently grappling with a sudden flight to quality. According to data tracked by Bloomberg, the GBP/USD pair has plummeted to its lowest level in eighteen months. This is not a standard macroeconomic correction. It is a reputational discount. Institutional investors, particularly sovereign wealth funds, are sensitive to governance metrics. The Epstein files have triggered a ‘Governance’ alert in ESG-weighted portfolios, leading to an automated reduction in UK exposure.

Gilt yields are reacting with predictable violence. As the perceived stability of the British government wavers, the demand for long-term sovereign debt has softened. This has forced yields higher to attract buyers, effectively raising the cost of borrowing for a government already stretched by fiscal promises. The technical mechanism here is simple: political instability increases the ‘term premium’—the extra compensation investors demand for holding debt in an uncertain environment.

UK Political Risk Premium (Gilt Yield Spread) Feb 10-12

The Atlantic Crossing

Washington is next. While the UK feels the immediate heat, the US dollar is showing signs of uncharacteristic fragility. The narrative of the ‘safe haven’ is being tested by the potential for high-level domestic fallout. If the Department of Justice is forced into a series of high-profile indictments involving the donor class, the legislative machinery in DC could grind to a halt. Markets hate a vacuum.

Per reports from Reuters, the volatility index (VIX) has spiked 15% in the last 48 hours. This reflects a growing fear that the Epstein fallout will lead to a ‘de-capitation’ of key financial and political influencers. When the people who move markets are under subpoena, the markets themselves stop moving in predictable patterns. We are seeing a rotation out of growth stocks and into hard assets, as the ‘reputational contagion’ spreads to the boardroom.

Comparative Asset Performance (48-Hour Window)

| Asset Class | Price Change (Feb 10-12) | Volatility Index (VIX) Impact |

|---|---|---|

| GBP/USD | -2.4% | High |

| FTSE 100 | -1.8% | Moderate |

| S&P 500 | -0.9% | Rising |

| Gold (Spot) | +1.2% | Safe Haven Inflow |

| 10-Year Gilt Yield | +45 bps | Extreme |

The Mechanics of Reputational Contagion

Reputational contagion functions through the tightening of credit conditions. When a major political or financial figure is implicated in a scandal of this magnitude, the institutions they are associated with undergo immediate internal audits. Banks become hesitant to extend credit. Counterparty risk is reassessed. This is the ‘shadow’ impact of the Epstein files. It is not just about the individuals named; it is about the networks they inhabited.

The SEC has already signaled increased scrutiny on disclosure requirements for public companies whose executives may be linked to the unsealed documents. This regulatory overhang acts as a drag on equity valuations. Investors are applying a ‘governance discount’ to any firm with even a tangential connection to the fallout. This is a cold, calculated move to insulate portfolios from the inevitable litigation and public relations disasters that follow such revelations.

The broader implication for the US dollar remains complex. Typically, domestic turmoil in the US strengthens the dollar as global investors flee to the most liquid market. However, if the turmoil suggests a fundamental breakdown in US institutional integrity, that liquidity becomes a trap. We are watching the 10-year Treasury yield closely for signs of a ‘credibility gap’ similar to what is currently plaguing the UK Gilts.

The next 72 hours are critical. The Senate Judiciary Committee is expected to announce a formal inquiry into the document release on February 15. Market participants should monitor the 1.2400 support level for the GBP/USD. If that floor breaks, the reputational discount may become a permanent fixture of the UK’s post-2025 economic landscape.