The Mathematics of a Liquidity Trap

Super Micro Computer (SMCI) is no longer a growth story; it is a clinical study in margin compression and regulatory failure. As of the market close on November 3, 2025, the stock sits at $18.42, a staggering collapse from its split-adjusted highs. The primary driver is not just the lack of audited financials, but a fundamental breakdown in the unit economics of AI server assembly. While the market obsessed over the NVIDIA Blackwell transition, SMCI ignored the structural shift in cost of goods sold (COGS). For the quarter ending September 30, 2025, preliminary data suggests gross margins have compressed to 9.4 percent. This is a fatal deviation from the 15.5 percent seen in early 2024.

The 10-K Default and the $1.7 Billion Debt Trigger

The company remains in a state of financial invisibility. Following the high profile resignation of Ernst & Young in October 2024, as reported by Bloomberg, the internal accounting controls have been effectively non-existent. Without a filed 2024 10-K, SMCI is in technical default on its $1.725 billion in convertible notes. The mechanism of this collapse is binary. If the company fails to provide an audited roadmap to the SEC by the end of this month, bondholders retain the right to demand immediate repayment. SMCI does not have the cash on hand to satisfy these obligations without dilutive emergency financing or a fire sale of inventory.

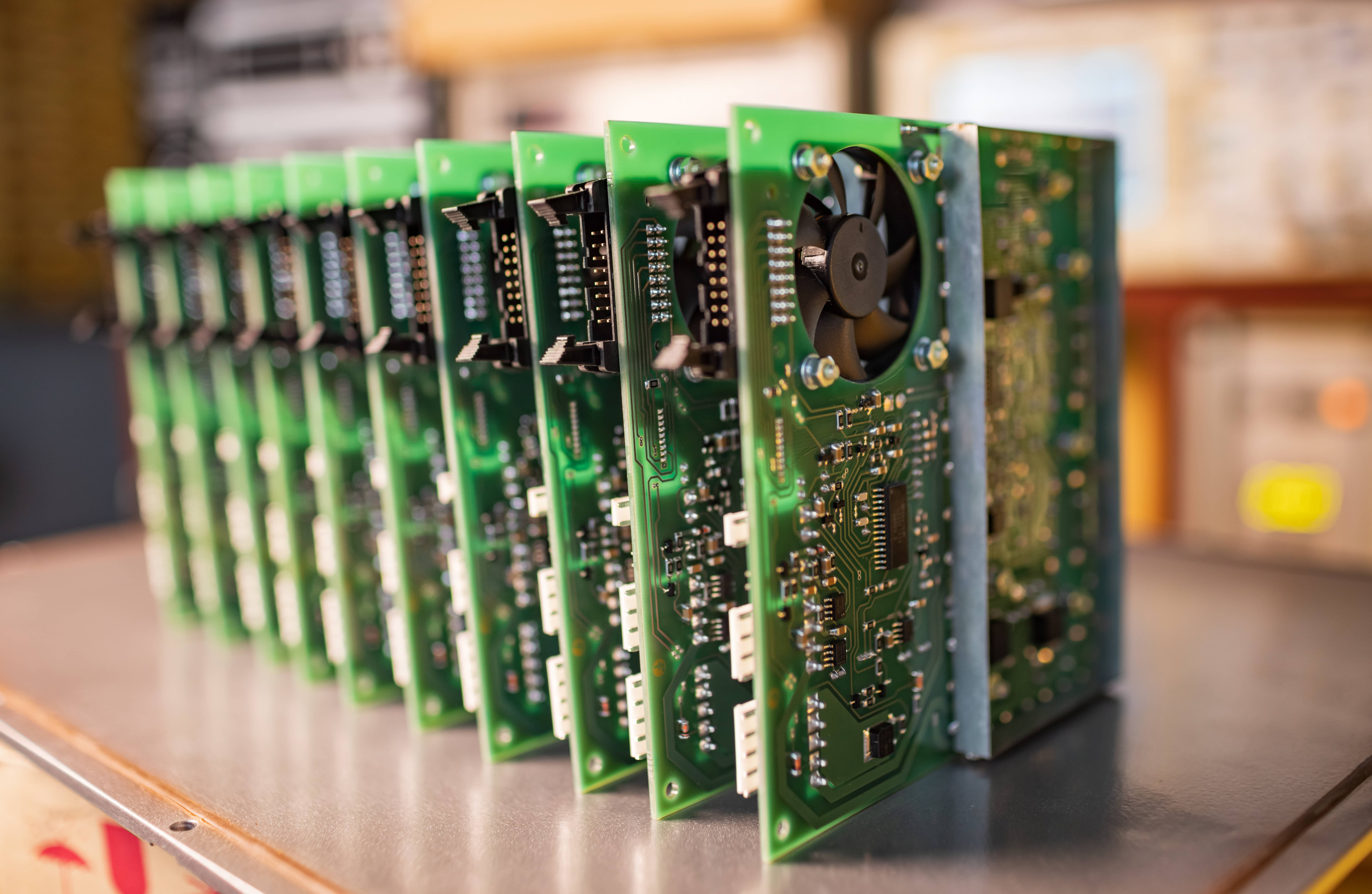

Visualizing the Margin Decay

The Competitive Cannibalization by Dell and HPE

SMCI once held a lead in liquid cooling for AI racks, but that moat has evaporated. Dell and HPE have successfully leveraged their superior supply chains to undercut SMCI on pricing for massive Tier 1 hyperscaler contracts. The following table illustrates the current disparity in operational efficiency between the three major OEMs according to the most recent SEC EDGAR filings and market estimates.

| Metric (Nov 2025) | Super Micro (SMCI) | Dell Technologies | HP Enterprise (HPE) |

|---|---|---|---|

| Gross Margin | 9.4% | 23.1% | 34.8% |

| Operating Margin | 4.1% | 7.8% | 10.2% |

| Audit Status | Non-Compliant | Compliant | Compliant |

| Free Cash Flow (Est) | -$120M | +$1.4B | +$850M |

Inventory Bloat and the Blackwell Pivot

The technical mechanism of SMCI failure is rooted in its inventory management. The company loaded its balance sheet with H100 and H200 components at peak pricing. As the market shifted toward the NVIDIA Blackwell architecture, SMCI was forced to aggressively discount its existing stock to maintain liquidity. This fire sale is what drove the gross margin below the 10 percent threshold. Unlike Dell, which operates on a build-to-order model with lean inventory, SMCI took a speculative long position on hardware that is now becoming obsolete. Per recent reports from Reuters, the server market is now prioritizing integrated software stacks where SMCI has zero intellectual property or recurring revenue.

The Governance Black Hole

Governance is not a secondary concern; it is the primary risk factor. The refusal to name a new Big Four auditor after twelve months suggests that the accounting discrepancies discovered by the previous auditor were not isolated incidents but systemic. Short sellers have highlighted the potential for round-trip transactions between SMCI and related parties in Asia. If these allegations are substantiated in a restatement, the current valuation of $18.42 still contains significant downside. The lack of an independent audit committee with any real authority has left retail investors exposed to a total loss of capital in the event of a Nasdaq delisting.

Watch for the February 2026 Compliance Deadline

The next critical milestone is the final Nasdaq delisting hearing scheduled for February 2026. If a certified 10-K is not produced by that date, the ticker will be moved to the OTC markets, triggering a forced liquidation by institutional holders who are barred from owning non-exchange listed securities. Watch the 10 percent gross margin line; if the next preliminary update shows a drop to 8 percent, the company will likely lose its ability to fund operations through current cash flow, necessitating a massive equity raise at distressed prices.