The Great Reinvestment Cliff of December 2025

The lights are dimming on the most profitable cash trade in a generation. On this Christmas morning, while the markets sleep, a quiet exodus is occurring within the $6 trillion mountain of capital currently sitting in money market funds. The era of the five percent risk-free return is officially sunsetting. For investors who spent the last twenty-four months hiding in short-term T-bills, the holiday cheer is tempered by a cold reality. The Federal Reserve has signaled a definitive pause, and the market is now aggressively pricing in the first rate cut of the coming year. This creates a massive reinvestment cliff. As those short-term instruments mature, the yields available for replacement are evaporating. The money is moving. It is moving toward duration, and it is moving fast.

The Goldman Sachs Gambit and the Multi-Sector Shift

Lindsay Rosner, the head of multi-sector fixed income investing at Goldman Sachs, has been signaling a pivot that many retail investors are missing. The alpha is no longer found in simply ‘owning the index.’ Per the latest Bloomberg bond market analysis, the correlation between equities and bonds has tightened, making traditional 60/40 portfolios more volatile than advertised. Rosner’s thesis centers on the ‘active’ component. She suggests that the reward for taking on credit risk in the investment-grade corporate sector currently outweighs the safety of Treasuries. This is the narrative of risk versus reward. If you stay in cash, you lose the opportunity to lock in these yields before the Fed moves. If you move too far into long-duration bonds, you risk a price collapse if inflation proves stickier than the consensus predicts.

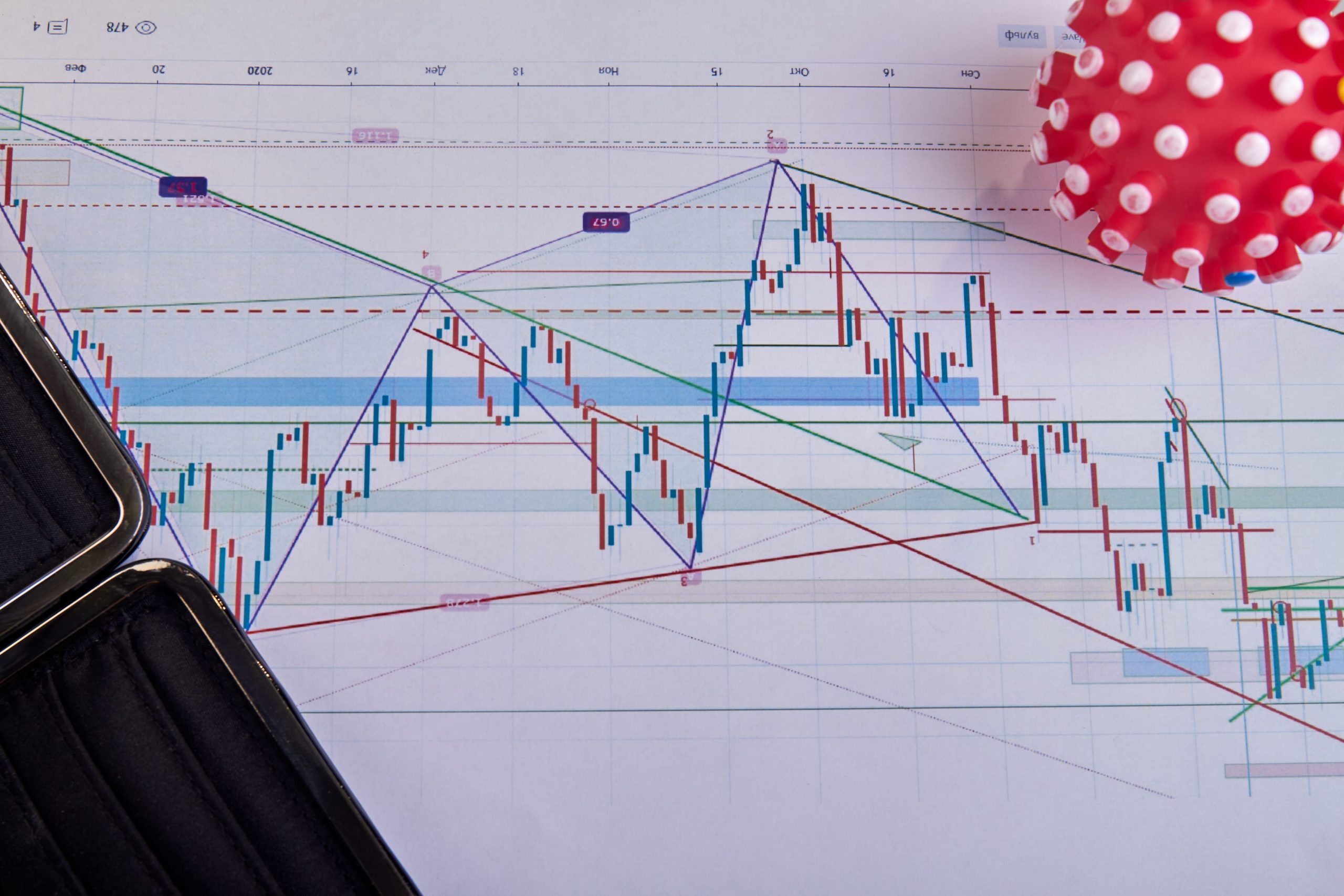

Convexity Is the Only Free Lunch Left

The mathematical reality of bond duration is often buried in textbooks, but in the current landscape, it is the primary engine of wealth creation. Duration measures a bond’s sensitivity to interest rate changes. As of yesterday’s Yahoo Finance treasury data, the 10-year yield is hovering near 3.8 percent. If the Fed cuts rates by 100 basis points over the next twelve months, a bond with a duration of ten years would see a price appreciation of approximately ten percent, plus the coupon. This is the ‘convexity’ play. However, it is a double-edged sword. If the fiscal deficit forces yields higher despite Fed policy, that same duration will savage a portfolio. The smart money is currently barbell-ing. They are holding very short-term liquidity and very long-term protection, skipping the ‘belly’ of the curve where the risk-to-reward ratio is least attractive.

The Technical Mechanism of the TIPS Insurance Policy

Inflation is not a ghost, it is a structural reality. While the headline CPI has cooled, the cost of services remains stubbornly high. Treasury Inflation-Protected Securities (TIPS) are the specific mechanism to hedge this. Unlike standard bonds, the principal of a TIPS bond increases with inflation and decreases with deflation, as measured by the Consumer Price Index. When the principal increases, the interest payment (which is a fixed percentage of the principal) also increases. We are seeing a massive institutional bid for TIPS right now as a ‘break-even’ play. If the market expects 2.5 percent inflation but we get 3.5 percent, the TIPS holder is the only one in the room not losing real purchasing power. This is the alpha that passive bond ETFs fail to capture effectively.

Credit Spreads and the Corporate Debt Wall

Corporate bonds are currently trading at tight spreads relative to Treasuries. This implies that the market is pricing in a perfect ‘soft landing.’ But follow the money to the ‘maturity wall.’ Many corporations are forced to refinance debt in early 2026 that was originally issued at two percent in 2021. They will now be facing six or seven percent coupons. This creates a divergence between high-quality issuers who can handle the heat and ‘zombie’ companies that cannot. Strategic allocation requires moving up the quality ladder. Investment-grade credit offers a yield cushion, but high-yield ‘junk’ bonds are currently a minefield where the reward does not justify the default risk.

| Bond Sector | Current Yield (Dec 25, 2025) | Risk Profile | Recommended Weighting |

|---|---|---|---|

| U.S. 10-Year Treasury | 3.82% | Low | Moderate |

| Investment Grade Corporate | 5.15% | Medium | Overweight |

| High-Yield (Junk) | 7.90% | High | Underweight |

| TIPS (Real Yield) | 1.75% | Low | Hedge |

The Forward-Looking Milestone

The first major data point to watch arrives on January 14. This is the release of the December CPI figures. This single report will determine if the Fed’s pivot was a masterstroke or a premature surrender. If core inflation print comes in above 0.3 percent month-over-month, the ‘duration trade’ will face its first liquidity test of the new year. Watch the 3.75 percent level on the 10-year Treasury note. A break below that level signals a rush to safety, while a bounce back toward 4.0 percent suggests the market is waking up to a structural inflation reality that the Fed cannot control.