The Penny That Anchors a Trillion Dollar Hegemony

The quarterly dividend is a ghost. To the retail observer, Nvidia’s declaration of a $0.01 per share payout on November 19, 2025, looks like a rounding error. It is anything but that. This nominal figure is the structural anchor for a 10-for-1 stock split that fundamentally reset the equity’s accessibility in June 2024. Before that split, the payout stood at a pre-adjusted $0.10, representing a 150 percent increase at the time. Today, that penny serves a specific institutional purpose. It allows the world’s largest pension funds and income-mandated ETFs to maintain their massive positions in a company that is currently the primary engine of the S&P 500 growth.

Capital discipline is the narrative. While the broader market remains fixated on the nominal dividend, the real story lies in the staggering cash flow generation reported in the Q3 fiscal 2026 earnings. Nvidia reported record revenue of $57 billion, a 62 percent surge from the previous year, as documented in the official November 19 investor release. This is not the behavior of a company seeking to appease shareholders with cash; it is the behavior of a monopoly reinvesting every possible cent into a supply chain that is currently stretched to its breaking point.

Blackwell and the Logistics of Onshoring

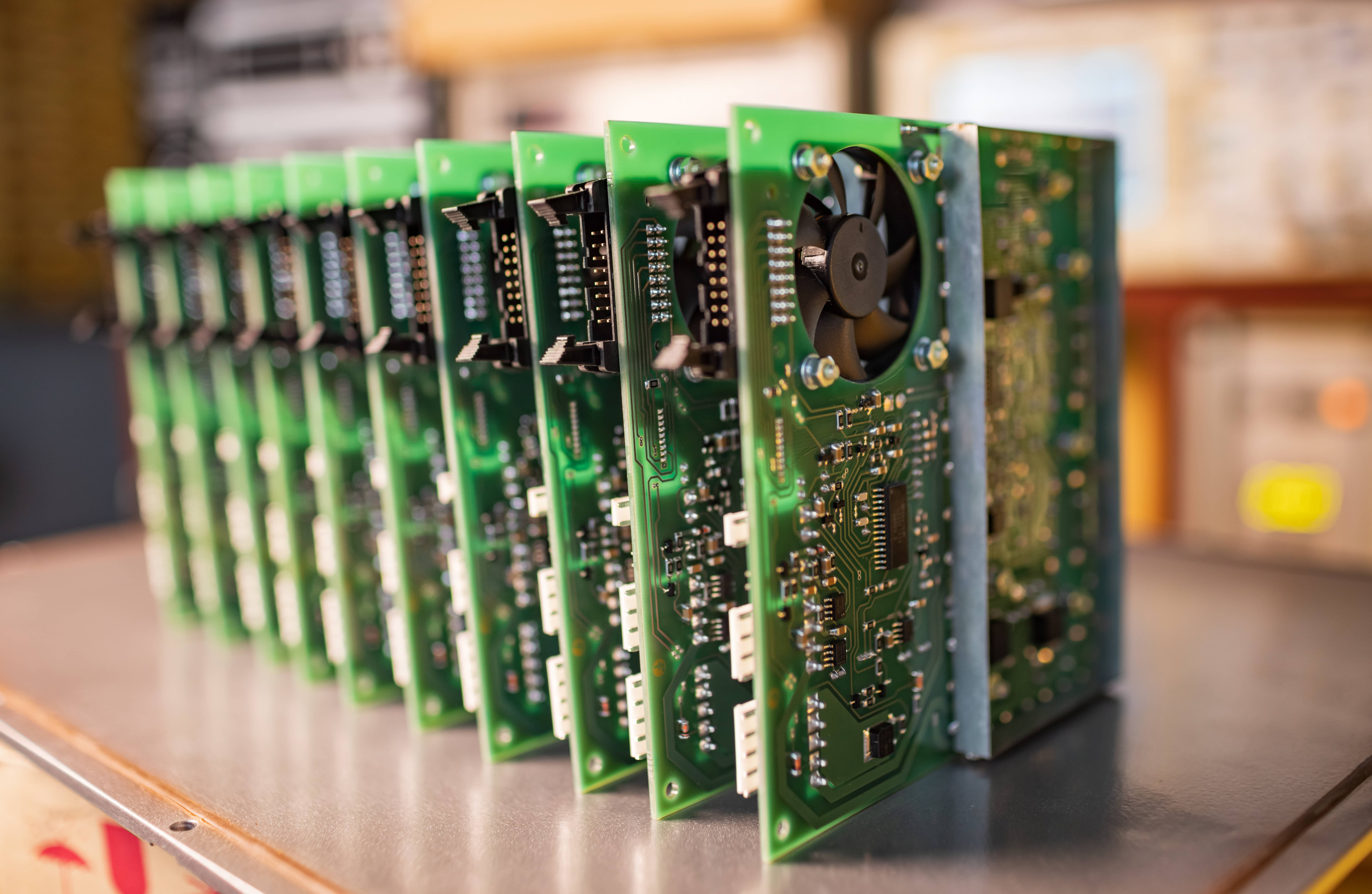

Supply is the only ceiling. CEO Jensen Huang confirmed yesterday that Blackwell demand is effectively off the charts. However, the technical hurdles are intensifying. Thermal management issues in high-density data center racks and the capacity of TSMC’s Chip-on-Wafer-on-Substrate (CoWoS) packaging have created a bottleneck that even $57 billion in quarterly revenue cannot immediately solve. The market is currently absorbing the news that the first Blackwell wafers have been produced on American soil at TSMC’s Arizona Fab 21, as reported by Reuters. This shift toward domestic production is a strategic hedge against the 25 percent licensing fees and geopolitical volatility currently impacting the H200 shipments to the Chinese market.

Margins are under the microscope. GAAP gross margins for the quarter came in at 73.4 percent. While objectively high, this reflects a slight contraction from the 74.6 percent seen a year ago. This margin compression is the price of a generational architectural transition. As Nvidia moves from the Hopper architecture to the Blackwell platform, the initial yield costs and the physical complexity of the GB200 Superchips are weighing on the bottom line. Analysts are watching for the moment the production ramp reaches economies of scale, likely by mid-2026, which would alleviate the current pressure on profitability.

Macroeconomic Resilience and the Yield Curve

Monetary policy provides the backdrop. With the Federal Reserve holding the target range at 3.75 to 4.00 percent this November, the cost of capital for Nvidia’s primary customers, the cloud hyperscalers, remains manageable. Microsoft, Amazon, and Google have signaled they will continue to escalate capital expenditures into 2026, regardless of the Fed’s next move. This creates a rare environment where Nvidia’s growth is decoupled from the traditional business cycle. The company is effectively operating in a sovereign economic zone where the demand for compute is treated as a non-discretionary utility rather than a capital investment.

Institutional absorption remains the primary driver of price stability. The $0.01 dividend, though small, prevents the massive mechanical selling that would occur if the stock were classified as a non-yielding asset. By maintaining this payout, Nvidia stays within the buy-box for thousands of conservative portfolios that are legally barred from holding purely speculative growth stocks. This is a deliberate psychological and structural play by CFO Colette Kress to lower idiosyncratic volatility as the company enters its most complex production cycle in history.

The Comparative Reality of Q3 Metrics

To understand the scale of the current expansion, one must look at the year-over-year delta in core operating segments. The shift is not incremental; it is a total industrial transformation.

| Metric | Q3 Fiscal 2025 (Nov 2024) | Q3 Fiscal 2026 (Nov 2025) | Year-over-Year Change |

|---|---|---|---|

| Total Revenue | $35.1 Billion | $57.0 Billion | +62% |

| Data Center Revenue | $30.8 Billion | $51.2 Billion | +66% |

| GAAP Gross Margin | 74.6% | 73.4% | -1.2 pts |

| Earnings Per Share | $0.78 (Split-Adj) | $1.30 | +67% |

| Quarterly Dividend | $0.01 | $0.01 | 0% |

The concentration of revenue in the data center segment now exceeds 89 percent. This creates a monolithic risk profile. Any delay in the January 2026 Blackwell ramp-up or a failure in the liquid cooling systems designed for the GB200 NVL72 racks would have a direct, catastrophic impact on the stock price. The margin of error has never been thinner, even as the cash reserves have never been larger. The market is no longer pricing Nvidia on its gaming history; it is pricing it on its ability to manufacture the physical infrastructure of the next industrial era.

By late January 2026, the data center industry will face its next major milestone: the first full-quarter revenue recognition of Blackwell systems. This data point will determine whether the current $65 billion guidance for the fourth quarter is a peak or merely a new baseline. For now, the technical focus remains on the yield rates at the Arizona facility, where a single percentage point improvement in 4nm silicon output could represent billions in additional market capitalization.