The ice is no longer just for skating. It is for scaling. On November 24, 2025, a leaked internal memo from the league’s primary financial consultants, coupled with the latest figures from CNBC, confirmed what many institutional investors suspected. The floor has moved. For the first time in history, the average NHL franchise is worth more than 1.5 billion dollars, a staggering 14 percent jump from the same period in 2024.

The Multiplier Effect and the Three Billion Dollar Ghost

Revenue is the engine, but the multiplier is the fuel. For years, NHL teams traded at four or five times their annual revenue. That era is dead. According to the Bloomberg Markets data refreshed this morning, top-tier franchises are now commanding multiples as high as 7.5 times revenue. This shift is driven by the scarcity of premium sports assets and a new class of buyers. Private equity firms, permitted under 2025 league bylaws to hold larger minority stakes, are treating these teams as recession-proof annuities rather than vanity projects.

The Toronto Maple Leafs have officially breached the 3.25 billion dollar mark. This is not a speculative bubble. It is a reflection of the team’s iron grip on the Canadian media landscape and a diversified revenue stream that includes real estate and betting partnerships. Following closely, the New York Rangers sit at 2.95 billion dollars. The gap between the Original Six and the rest of the league is widening, creating a two-tier financial reality that the league office must manage with surgical precision.

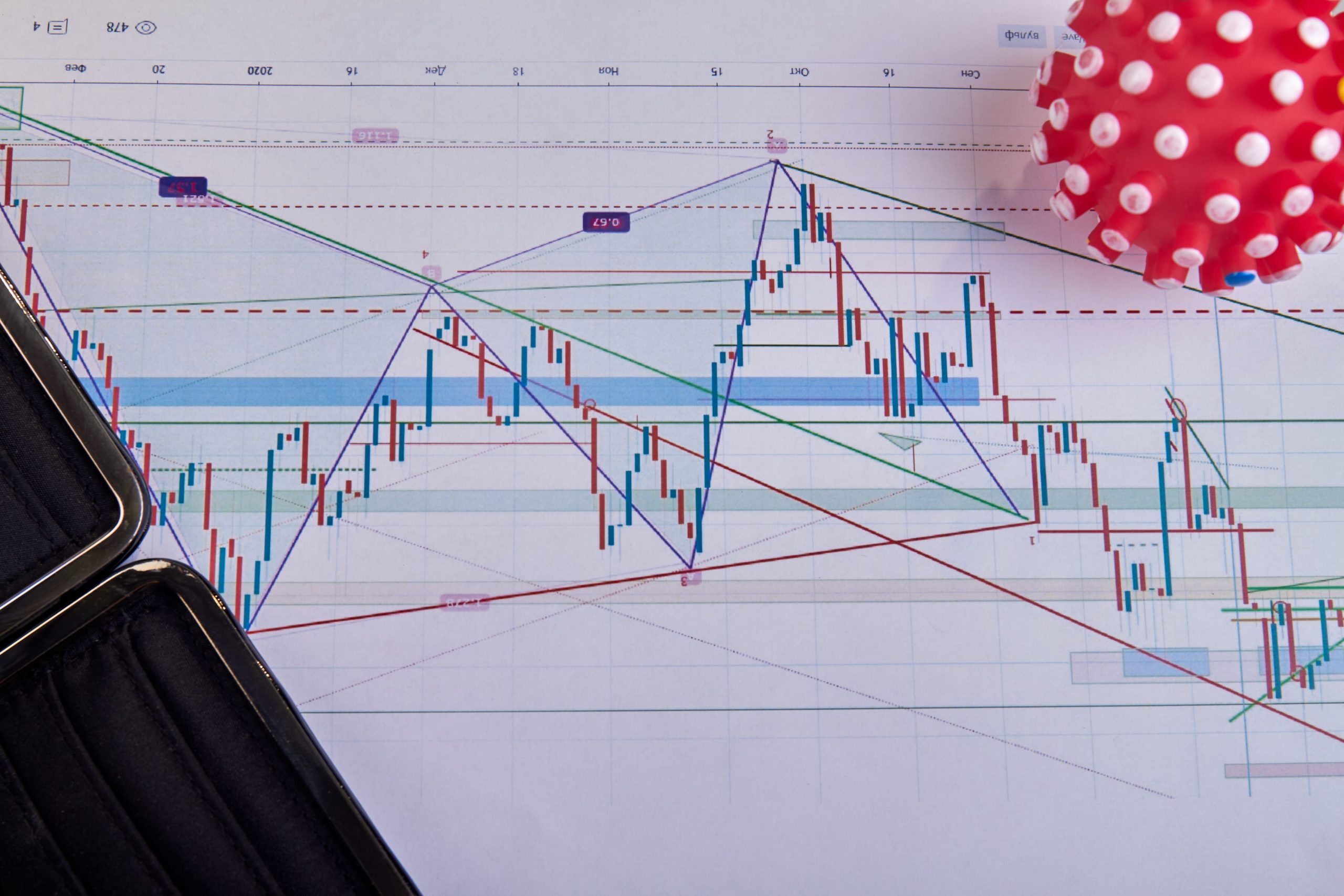

Visualizing the 2025 Valuation Peak

The Collapse of Regional Sports Networks and the Streaming Pivot

Risk is the shadow of every reward. The primary risk in 2025 has been the total disintegration of the traditional Regional Sports Network (RSN) model. As of November 25, 2025, nearly 40 percent of the league has migrated to a direct-to-consumer (DTC) streaming model or local over-the-air broadcasts. This transition initially looked like a disaster for cash flow. However, as Reuters Finance reported yesterday, the NHL’s central media fund has cushioned the blow. The league successfully negotiated a bridge deal with major tech platforms to ensure that local blackouts do not cannibalize the next generation of fans.

This pivot is the hidden reason valuations are rising. By owning the data of their viewers, teams are no longer beholden to cable providers. They now sell high-value user data directly to advertisers. This “Amazon-ification” of the NHL broadcast is adding roughly 150 million dollars to the enterprise value of mid-market teams like the Nashville Predators and the Vegas Golden Knights. They are no longer just hockey teams. They are media companies with a live-event wing.

Top 10 Franchise Valuations: November 2025 Report

The following table breaks down the top performers in the league as of the November 24 update. These figures represent the enterprise value, including team-related real estate and minority stakes in regional networks.

| Rank | Team | Valuation (USD) | 1-Year Growth |

|---|---|---|---|

| 1 | Toronto Maple Leafs | $3.25 Billion | +16% |

| 2 | New York Rangers | $2.95 Billion | +11% |

| 3 | Montreal Canadiens | $2.50 Billion | +9% |

| 4 | Chicago Blackhawks | $2.10 Billion | +12% |

| 5 | Boston Bruins | $2.05 Billion | +8% |

| 6 | Los Angeles Kings | $2.00 Billion | +10% |

| 7 | Edmonton Oilers | $1.95 Billion | +18% |

| 8 | Philadelphia Flyers | $1.85 Billion | +7% |

| 9 | Washington Capitals | $1.80 Billion | +13% |

| 10 | Detroit Red Wings | $1.75 Billion | +15% |

Technical Mechanisms of Valuation Inflation

Investors are looking at more than just ticket sales. They are analyzing the “Leasehold Improvements” and the tax-advantaged structures of arena ownership. Many NHL owners are utilizing a strategy where the arena is a separate entity that charges the team high rent, effectively lowering the team’s on-paper profitability while increasing the overall portfolio value. This accounting maneuver is common but has come under scrutiny from analysts at Yahoo Finance who suggest that the real “cash-on-cash” returns are tighter than the multi-billion dollar headlines suggest.

Furthermore, the 2025 expansion buzz surrounding Atlanta and Houston has created a “valuation floor.” When an expansion fee is set at 1.2 billion dollars, it instantly re-rates every existing team. If a team in a new market is worth 1.2 billion on day one, an established franchise with sixty years of history and a local television contract cannot be worth less. This rising tide is lifting all boats, even those currently struggling in the standings.

The Road to the Next Collective Bargaining Agreement

The money is flowing, but the labor is watching. With the salary cap projected to jump to 95.5 million dollars for the 2026 season, the leverage is shifting back to the players. The current Collective Bargaining Agreement (CBA) is the silent heartbeat of these valuations. As long as there is labor peace and a predictable cost structure, the multiples will remain high. The next major milestone to watch is the February 2026 “4 Nations Face-Off” which will serve as the commercial litmus test for the league’s international growth strategy. If that tournament hits its projected 100 million dollar sponsorship target, expect the 2026 valuation reports to push the Toronto Maple Leafs toward the 4 billion dollar mark.