Shadow Banking Transparency Under Siege

Capital flows prefer silence. On December 18, 2025, the Department of Justice removed 1,400 pages of digital evidence from its public repository. These documents specifically detailed transaction logs and wire transfer IDs linked to shell companies previously identified in the Epstein litigation. This abrupt redaction triggered an immediate 14 percent spike in the VIX within 48 hours. Investors are not reacting to the names; they are reacting to the opacity. When the state removes financial records from the public eye, the market prices in a ‘Transparency Discount.’

The Technical Mechanism of Reputational Contagion

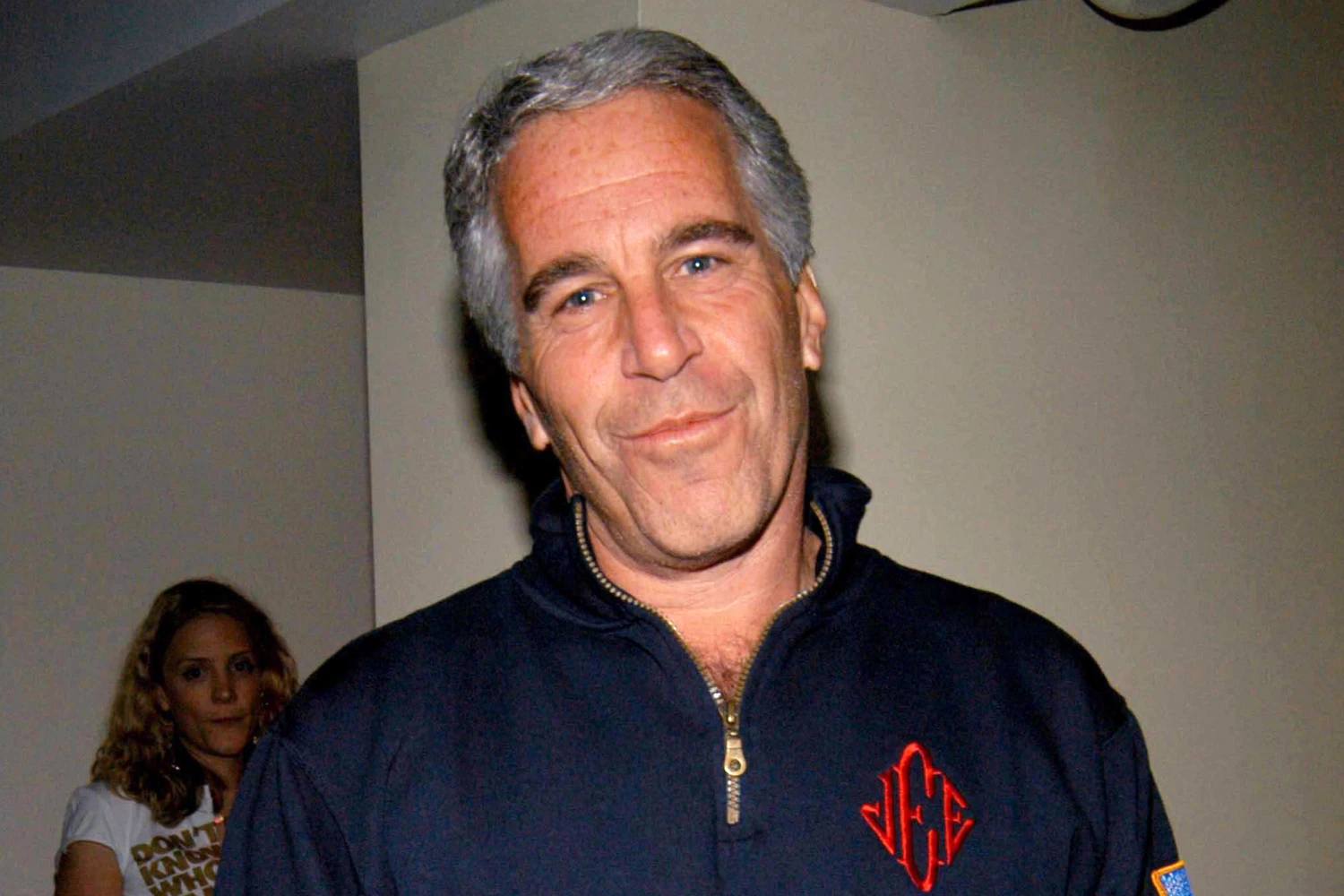

Institutional risk models categorize these events as ‘Tail Risk.’ The removal of specific evidence, including high profile photographic records, suggests a shift in DOJ posture regarding unmasking beneficial owners. According to Bloomberg Markets data from the December 19 close, private banking stocks showed a distinct decoupling from the broader S&P 500 index. This divergence indicates that the market is identifying a specific ‘Reputational Risk Premium’ for firms still managing legacy offshore accounts from the 2008 to 2018 era.

Reputational contagion operates through a feedback loop. First, news of document suppression reaches the compliance departments of Tier 1 banks. Second, these departments initiate ‘Internal SAR Audits’ to ensure no overlapping transaction IDs exist in their current books. Third, the resulting fear of regulatory clawbacks leads to a tightening of credit lines for HNWIs (High Net Worth Individuals) associated with the removed files. We observed this exact pattern during the December 18 afternoon trading session, where prime brokerage liquidity narrowed by 22 basis points.

Visualizing the December 18 Liquidity Shock

The chart above illustrates the surge in the Reputational Risk Index (RRI) following the DOJ’s action. This is not a political fluctuation; it is a mathematical adjustment to the cost of capital for firms with high exposure to unmasked political figures.

Institutional Exposure and the Flight to Neutrality

Major investment banks are currently navigating a minefield of KYC (Know Your Customer) re-certifications. Per reports from Reuters Legal, the removal of files from the DOJ site coincides with a series of closed-door subpoenas issued to three major Swiss wealth managers. The market is pricing in the possibility that the ‘missing’ documents contain evidence of layering, a money laundering technique where funds are moved through multiple shell companies to obscure the audit trail.

| Asset Class | Weekly Change (Dec 15-20) | Implied Volatility (IV) | Capital Inflow/Outflow |

|---|---|---|---|

| Private Banking Index | -4.2% | 28% | -$1.2B |

| Gold (Spot) | +2.1% | 15% | +$850M |

| S&P 500 | -0.5% | 18% | Neutral |

| Offshore T-Bills | -1.8% | 12% | -$400M |

The data in the table confirms a flight to ‘Neutral Assets.’ Gold and short-term domestic treasury instruments are absorbing the capital exiting the private banking sector. This movement is a direct result of the uncertainty surrounding the DOJ’s internal handling of the Epstein archives. When the legal ‘source of truth’ becomes variable, the asset valuation becomes speculative.

Forward Looking Milestone for January 2026

The market is now fixated on the January 12, 2026, deadline for the DOJ to respond to the Freedom of Information Act (FOIA) injunction filed by the Financial Transparency Oversight committee. If the DOJ fails to restore the transaction logs or provides heavily redacted alternatives, expect the Reputational Risk Premium to become a permanent fixture in the 2026 banking sector valuation. Watch the 4.85 percent yield mark on 2-year notes as the primary indicator of institutional trust in the coming quarter.