The Morning the Music Slowed

It is 8:31 AM on Friday, December 05, 2025. The Bureau of Labor Statistics just released the November jobs report, and the numbers are a cold shower for the bulls. With only 162,000 non-farm payrolls added against a consensus of 185,000, the narrative of an invincible economy is hitting a structural wall. For David Kostin, Goldman Sachs’ Chief US Equity Strategist, this data point is the final piece of a puzzle he began assembling a year ago. The market is currently hovering at 6,342, just points above his 6,300 terminal target, and the air is getting thin. Money is no longer flowing into everything. It is fleeing from the speculative periphery toward the fortress balance sheets of the few.

Following the Capital Migration

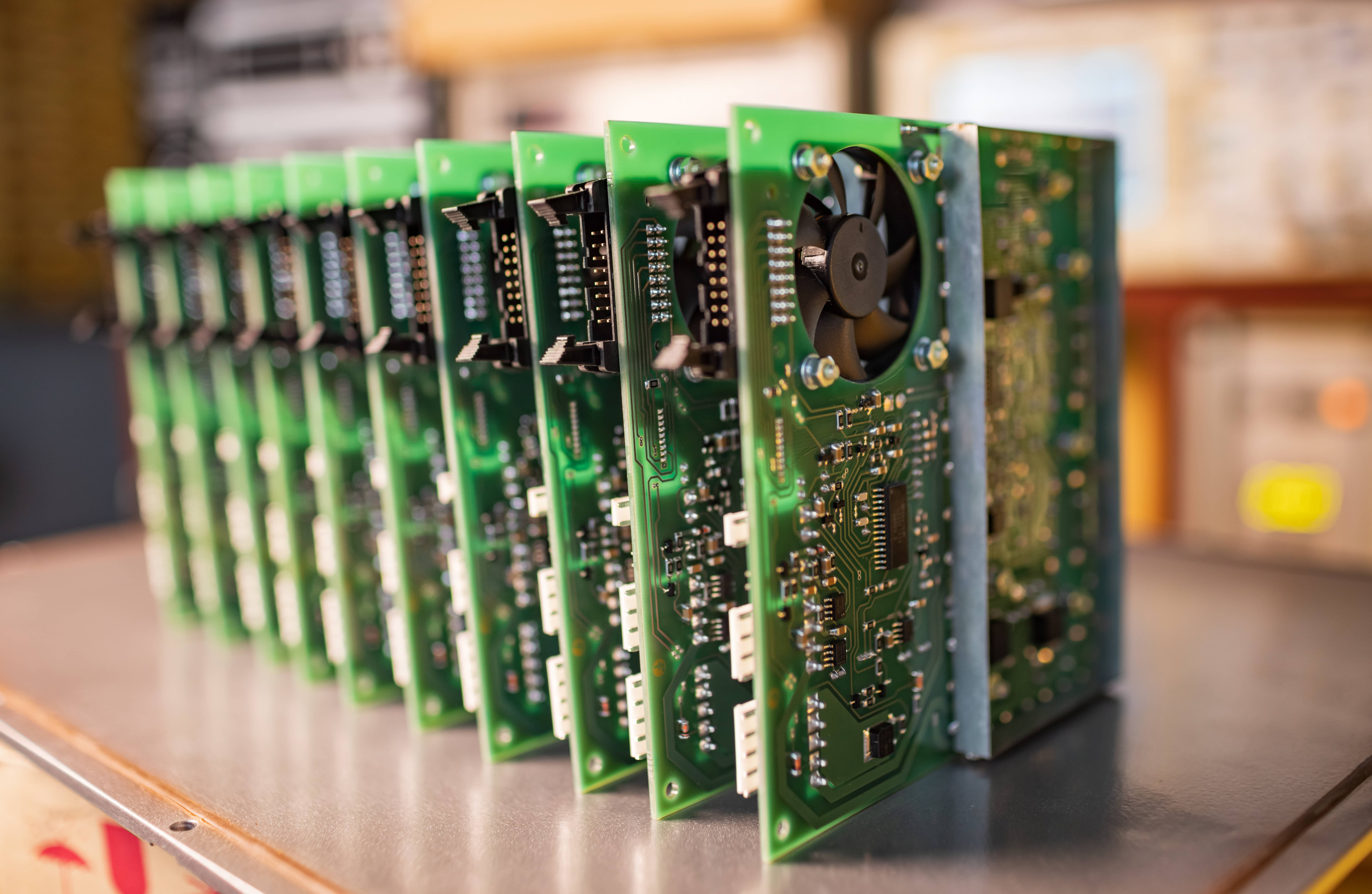

The transition from 2024 to 2025 was defined by the transition from AI training to AI inference. While the previous year saw a blind rush into hardware, the current capital flow is far more surgical. Per the latest Bloomberg market data, the premium on the Magnificent 7 has compressed. Investors are no longer paying for potential. They are demanding proof of monetization. Kostin has been vocal about the narrowing gap between the top tier and the other 493 stocks in the S&P 500. This is not a broad market rally anymore. It is a game of sector rotation where the winners are those who can maintain margins in a high-cost labor environment.

We are seeing a massive divergence in the Equity Risk Premium. At current levels, the stock market is priced for perfection, yet the credit markets are signaling caution. The spread between high-yield bonds and Treasuries has begun to widen for the first time in three quarters. This suggests that while the index looks healthy, the underlying components are struggling with a higher-for-longer interest rate reality that the Fed seems reluctant to abandon despite the cooling jobs data.

The Earnings Yield Gap and the Valuation Trap

The primary risk for 2025 has always been the valuation trap. When Kostin updated his model in late 2024, he pointed to a P/E multiple of 21.5x as the ceiling for the S&P 500. Today, we are pushing 22.1x. This expansion is not backed by a sudden surge in productivity. It is backed by a scarcity of alternatives. As noted in Reuters’ analysis of the Fed’s December terminal rate expectations, the market is betting on three cuts in early 2026. If those cuts do not materialize because of sticky service inflation, the current valuations will collapse under their own weight.

Consider the technical mechanism of the current tech dominance. It is no longer about the chips. It is about the power grid. Utilities have become a proxy for AI growth as the data center energy demand outstrips supply. This has created a bizarre correlation where tech and defensive sectors move in lockstep. This is the hallmark of a late-cycle environment where investors are trying to find growth that can also survive a recession. The risk is that these crowded trades have zero margin for error. A single miss on guidance from a major hyperscaler could trigger a multi-hundred point slide in the index within a single trading session.

The Leverage Problem in the Other 493

While the headlines focus on trillion-dollar valuations, the investigative eye must look at the bottom of the index. The cost of debt for mid-cap companies has doubled since 2022. Many of these firms are facing a wall of refinancing in 2026. Goldman’s proprietary data suggests that a significant portion of the S&P 500 is currently spending more on interest payments than on research and development. This is a recipe for long-term stagnation. We are witnessing a bifurcated market where the elite companies are flush with cash while the rest are essentially running on a treadmill of high-interest debt.

Key Market Indicators as of December 05, 2025

| Indicator | Current Value | 12-Month Change | Status |

|---|---|---|---|

| S&P 500 Index | 6,342.12 | +14.2% | Overvalued |

| 10-Year Treasury Yield | 4.12% | -0.15% | Neutral |

| November Jobs Print | 162,000 | -12.0% | Weakening |

| AI Sector P/E Ratio | 34.5x | +8.0% | Extreme |

The reward for staying invested in this market is becoming increasingly asymmetric. To the upside, we might see another 2 or 3 percent if the Fed signals a dovish pivot on December 17. To the downside, the gap back to the 200-day moving average is a precipitous 11 percent drop. Kostin’s math is clear. The era of easy beta is over. The coming months will be defined by alpha generation through idiosyncratic stock picking rather than riding the index wave.

The Next Milestone

All eyes are now fixed on the December 17 Federal Open Market Committee meeting. The market is pricing in a 68 percent probability of a 25 basis point cut, but the real data point to watch is the updated Dot Plot for 2026. If the median projection moves above 4 percent, it will signal that the Fed is comfortable with a slower growth environment to keep inflation in check. This would effectively cap the S&P 500 at its current levels and force a violent rotation out of growth into deep value sectors that have been ignored for the better part of a decade. Watch the 2-year Treasury yield on the afternoon of December 17. Any move above 4.35 percent will be the signal that the 6,300 ceiling is finally being enforced.