The narrative shifted overnight. For decades, the financial establishment treated gold as a pet rock that only performed when the world was ending. That dogma died on November 5, 2025. Following the volatility of the US election cycle, the yellow metal has decoupled from traditional treasury yield correlations. We are witnessing the birth of a new monetary regime where sovereignty outweighs yield.

The Post Election Liquidity Surge

Volatility is the new baseline. As of November 07, 2025, spot gold is trading at $2,782.40, a staggering 34 percent increase since the start of the year. This is not just inflation hedging. It is a systemic flight to collateral. According to real-time Bloomberg terminal data, the premium on physical delivery over paper futures has reached a three year high. The market is signaling that it no longer trusts the digital representation of wealth.

Wall Street is scrambling to catch up. Goldman Sachs analysts, led by Daan Struyven, recently revised their year end target, suggesting that gold could breach the $3,000 mark before the first quarter of 2026. This is a massive pivot from the conservative $2,200 estimates seen in early 2024. The catalyst is clear. The US fiscal deficit is now viewed as a permanent fixture, regardless of the administration in power. Debt service costs have surpassed defense spending, forcing the Federal Reserve into a corner where they must tolerate higher inflation to keep the government solvent.

The Death of the Real Rate Correlation

The old guard is confused. Historically, when real interest rates go up, gold goes down. That relationship has disintegrated. In the last 48 hours, despite a slight tick up in the 10 Year Treasury yield to 4.35 percent, gold prices remained resilient. This suggests that the buyer of last resort is no longer the Western retail investor but the Eastern central bank.

Sovereignty Over Yield

Central banks are playing a different game. Per the World Gold Council data updated this week, the People’s Bank of China (PBOC) and the Reserve Bank of India have continued their silent accumulation. While official reports showed a pause in Chinese buying earlier in 2025, the data on gold flows into the Shanghai Gold Exchange tells a more aggressive story. They are not buying for a 5 percent return. They are buying to insulate their economies from the weaponization of the US Dollar.

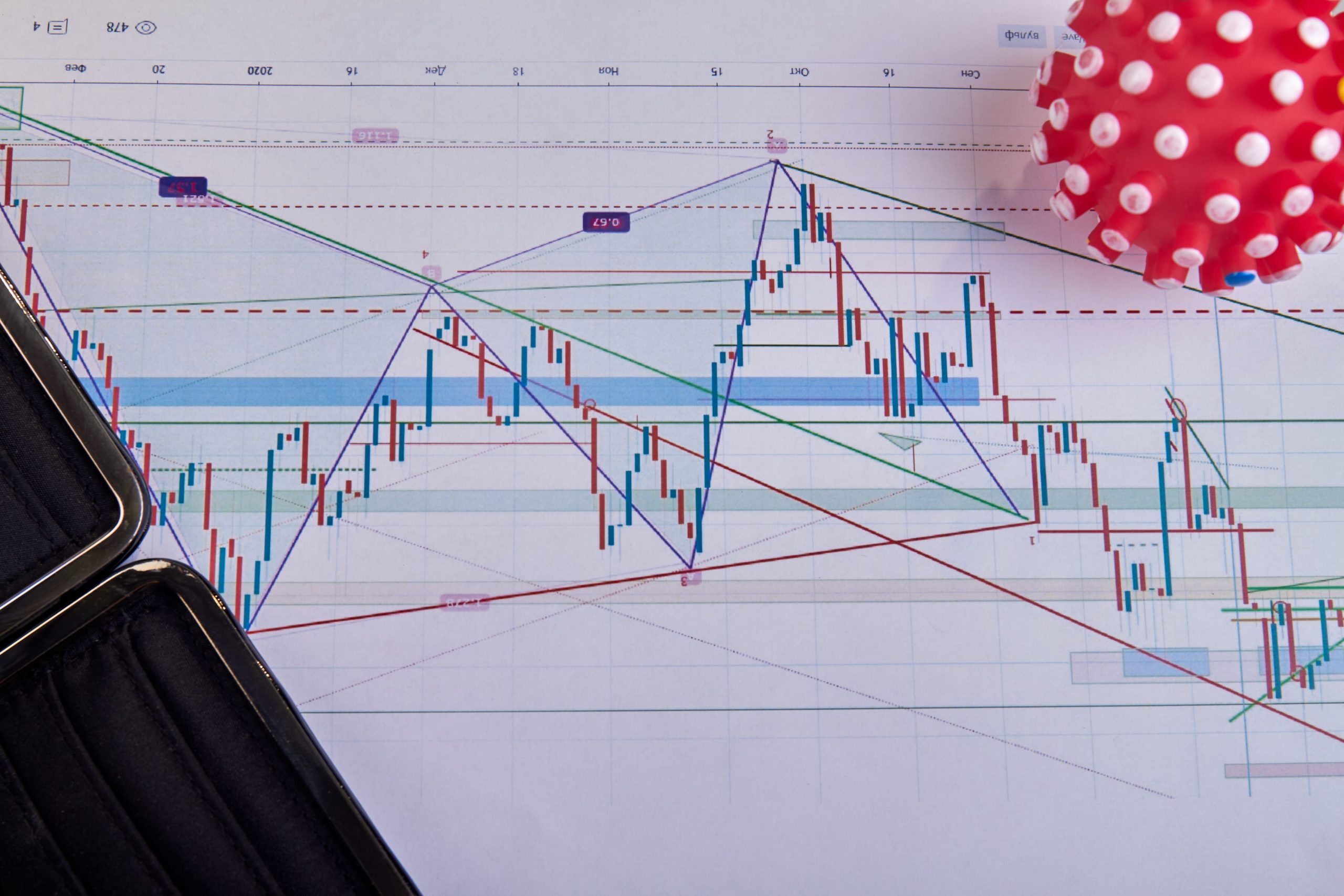

The technical mechanism of this shift is the “Great De-leveraging.” As nations move away from Treasury bonds, the vacuum is filled by gold. This is a structural change, not a cyclical one. Investors who are waiting for a “correction” to $2,000 are using a map of a world that no longer exists. The support floor has moved. Technical analysts at Citi now point to $2,650 as the new institutional accumulation zone.

Comparing the 1979 Rally to the 2025 Reality

The media loves the 1979 comparison. It is a lazy analogy. In 1979, the rally was driven by a singular spike in oil prices and the Iranian hostage crisis. Today, the drivers are multifaceted: AI energy demands, a fragmented global trade system, and a multi polar currency world. The following data highlights the difference in market depth between the two eras.

| Metric | 1979 Peak Context | November 2025 Reality |

|---|---|---|

| Annual Central Bank Net Buying | Net Sellers (-200t) | Net Buyers (+1,100t) |

| US Debt to GDP Ratio | ~32% | ~125% |

| Global Gold ETF Holdings | Non-existent | 3,200+ Tonnes |

| Average Daily Trading Volume | $2B (Estimated) | $165B+ |

Physical scarcity is the next frontier. We are seeing a massive backlog at the LBMA (London Bullion Market Association) for physical delivery. Large institutions are no longer content with paper contracts. They want the metal. This physical tightness is creating a coiled spring effect. If a major pension fund or a secondary central bank announces a 5 percent allocation to gold in the next few weeks, the liquidity trap will snap shut.

The Logistics of the 2025 Bull Run

Retail sentiment is finally waking up. For most of 2024, the rally was driven by institutions. But in the 48 hours following the election, search interest for “how to buy physical gold” spiked by 400 percent. According to reports from Reuters commodity desks, major mints in Perth and the United States are already reporting two week delays on 1oz bullion coins. This is the hallmark of a retail mania phase that has only just begun.

Institutional players like Aakash Doshi at Citi have argued that gold is the only remaining “unstoppable” asset class. The reasoning is simple: you cannot print more gold to pay for social programs or geopolitical conflicts. As the market looks toward the January 2026 budget debates, the anticipation of further currency debasement is being priced in today. The risk is no longer being in gold, the risk is being out of it.

The next major milestone is the January 20, 2026, policy transition. Watch the $2,850 technical resistance level. If gold closes above this mark by the end of December 2025, the psychological path to $3,200 is clear. The era of the pet rock is over. The era of the strategic reserve asset has arrived.