The Era of Blind Optimism Ends Today

The honeymoon is over. On this Wednesday, November 19, 2025, the global technology sector is no longer trading on the feverish dreams of 2023. We have moved from the era of ‘What is AI?’ to the cold, hard reality of ‘Where is the return on investment?’ While the 2023 Sunak-led AI Safety Summit promised a unified global race, the 2025 reality is a fragmented, protectionist landscape where compute power is the only currency that matters. The markets are currently holding their breath as NVIDIA (NVDA) prepares to release its Q3 fiscal results after the bell today, a report that will either validate the $2 trillion in global infrastructure spend or trigger a systemic repricing of the entire tech stack.

The India Delusion and the 2032 Mirage

India remains the most ambitious outlier in the semiconductor space. The IT Ministry continues to push the narrative that India will achieve parity with Taiwan by 2032. However, the 2025 data tells a more nuanced story. While the Micron assembly plant in Sanand has successfully reached its second phase of production, the actual fabrication of 28nm legacy chips remains elusive. The capital expenditure required to bridge this gap is staggering. Per the latest Q3 2025 supply chain reports, India’s domestic yield accounts for less than 1 percent of global logic chip demand. The bottleneck is not just money, it is the specialized workforce. Investors must look past the headlines and monitor the actual shipment volumes from Tata Electronics, which are currently focused on back-end packaging rather than the high-margin front-end lithography dominated by ASML.

The Raimondo Doctrine and the New Trade Wall

U.S. Secretary of Commerce Gina Raimondo recently clarified that ‘America First’ has evolved into a policy of strategic containment. This is no longer about supporting domestic growth, it is about active technological denial. The export controls updated in October 2025 have effectively severed the top-tier GPU market from several emerging economies. This policy has created a ‘Grey Market’ for H200 and B200 chips, where prices in the secondary markets are now 40 percent higher than MSRP. For companies like Broadcom (AVGO) and Marvell (MRVL), this creates a volatile revenue stream that is increasingly dependent on navigating the labyrinth of Department of Commerce licenses. The latest NVDA 10-Q filings suggest that nearly 15 percent of projected revenue is now subject to direct geopolitical risk, a figure that was negligible only three years ago.

Yield is the Only Metric That Matters

Wall Street has shifted its focus from ‘Total Addressable Market’ to ‘Foundry Yield.’ The transition to 2nm process nodes at TSMC (TSM) has encountered more friction than anticipated. According to Bloomberg’s November market indices, the cost of manufacturing a single wafer has increased by 22 percent year-over-year. This inflation is being passed directly to the consumer, which explains why the latest Blackwell-generation servers are seeing elongated procurement cycles. Enterprise software companies that promised AI-driven margin expansion are now facing ‘Capex Fatigue.’ If the cloud service providers like Microsoft and Google cannot demonstrate that their AI revenue is growing faster than their hardware depreciation, the sector faces a significant valuation reset.

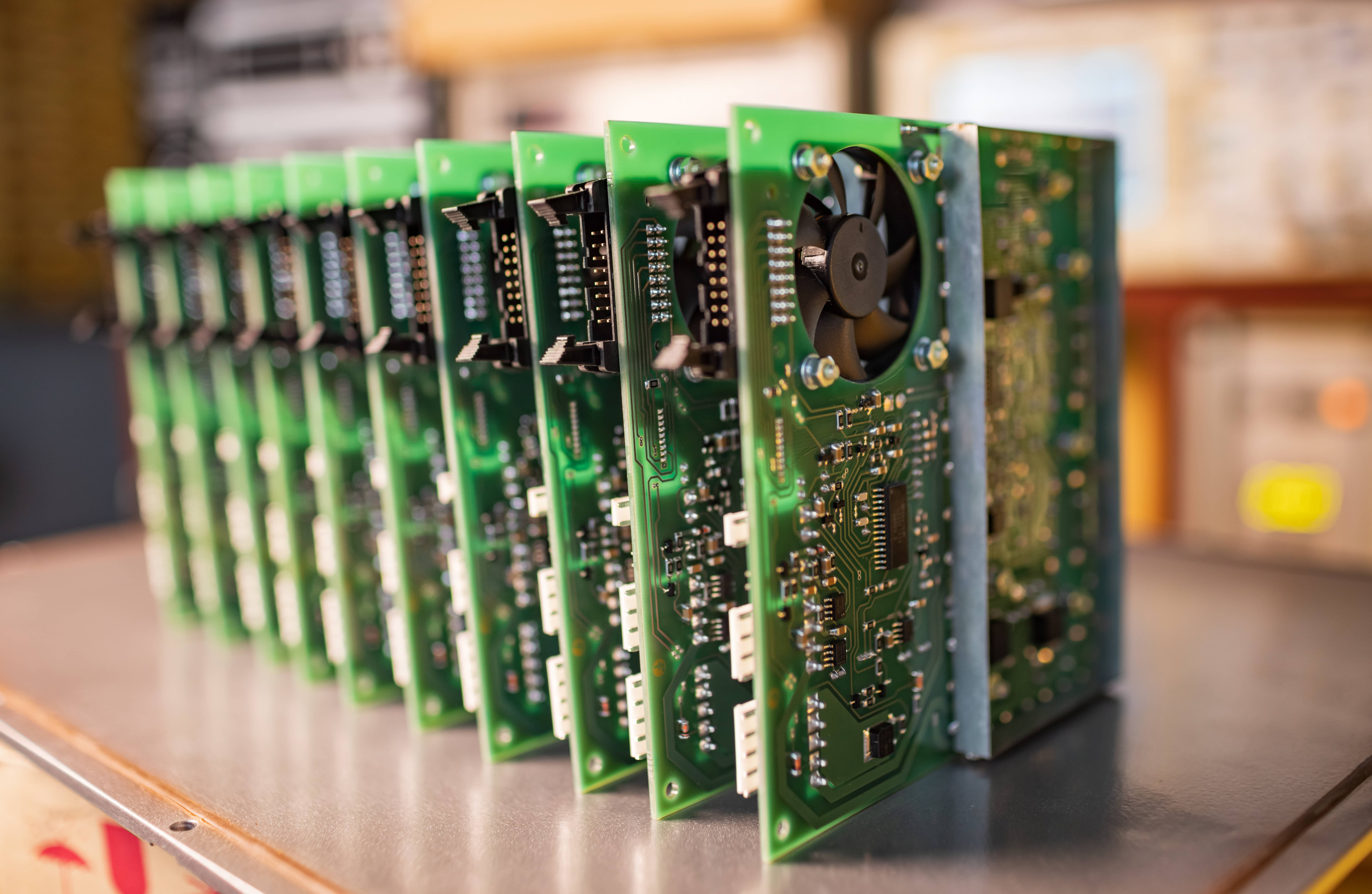

Contrarian Play: The Rise of Edge AI

While the world watches the massive data centers, the real movement is happening at the edge. The consensus view that ‘bigger is better’ for Large Language Models (LLMs) is being challenged by Small Language Models (SLMs) that run locally on NPU-enabled laptops and smartphones. This shift favors legacy players who have been ignored during the GPU mania. Companies like Qualcomm (QCOM) and Arm (ARM) are positioned to capture the value of the ‘Inference Era’ where the processing happens on the device, not in the cloud. This reduces the dependency on the strained energy grids of Northern Virginia and Ireland, which are currently at a breaking point due to the power demands of H100 clusters.

The Technical Mechanism of the 2025 Power Crisis

The physical limit of the AI expansion is not silicon, it is electricity. The technical mechanism of this bottleneck is simple. A standard H100 cluster requires approximately 1,000 watts per GPU. As clusters scale to 100,000 units, the local grid must provide 100 megawatts of continuous power. In November 2025, data center operators are reporting lead times of 36 months for high-voltage transformers. This physical infrastructure delay is the primary reason why the ‘Sovereign AI’ ambitions of the UK and India are stalling. You can buy the chips, but you cannot power them. This is the hard ceiling that the 2023 speculators failed to account for.

The next critical milestone for the global market will be the January 20, 2026, ASML booking report. That data will reveal whether the chip manufacturers are doubling down on capacity or if they are finally pulling back in anticipation of a 2026 supply glut. Watch the 10-year Treasury yield, as its current 4.5 percent level is putting immense pressure on the debt-heavy infrastructure plays that define the current AI landscape.