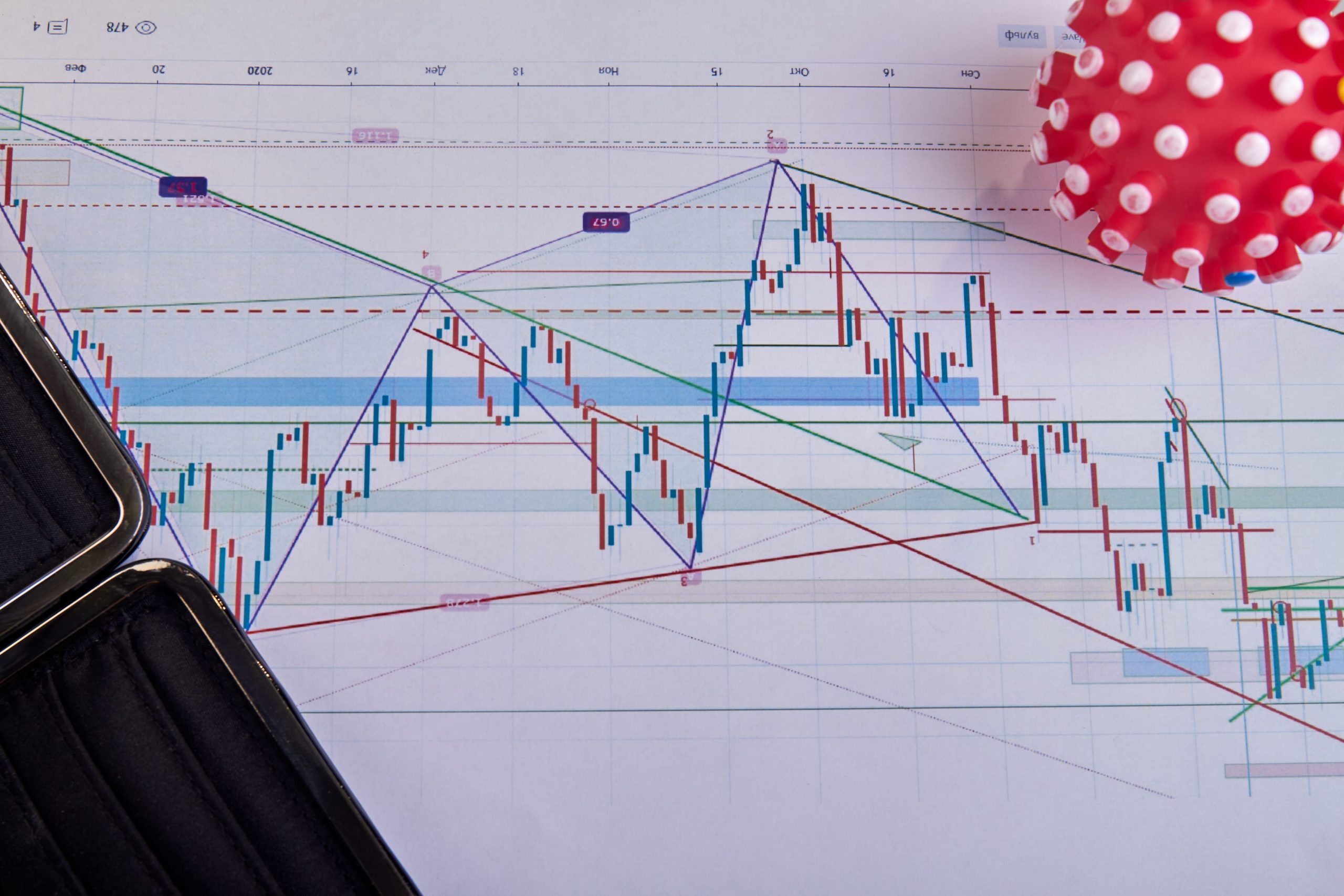

Yield Compression and the October Liquidity Gap

The 10-Year Treasury yield surged to 4.28 percent yesterday, October 14, following a hotter than expected producer price index print. This move effectively suffocated the relief rally seen in early October. The spread between the 2-year and 10-year Treasury notes has moved into positive territory by 14 basis points, marking a definitive end to the longest inversion in history. While historical narratives suggest de-inversion is a bullish signal, the current velocity of the move indicates a term premium repricing that threatens high-multiple equities. Investors holding software-as-a-service (SaaS) stocks at 15x forward sales are now facing a discount rate reality check that the market ignored during the summer frenzy.

The Blackwell Bottleneck and NVIDIA Realities

NVIDIA (NVDA) remains the gravitational center of the S&P 500, yet the technicals are fraying. As of the October 14 market close, NVDA sits at 138.40 dollars, down 4.2 percent from its late September peak. The primary catalyst is not demand, which remains robust, but the logistical friction in Blackwell B200 shipments. According to recent supply chain audits via Bloomberg, thermal management yields at the packaging level are still hovering below 85 percent. This creates a margin ceiling that the market has not priced in. While the street expects 75 percent gross margins, the reality of the Blackwell ramp-up suggests a dip toward 71 percent in the next two quarters. This 400 basis point gap represents the difference between a 150 dollar stock and a 115 dollar stock.

The Nuclear Pivot in Energy Infrastructure

Data center power requirements have decoupled from traditional grid capacity. The October 13 announcement regarding Small Modular Reactor (SMR) integration for hyperscalers has shifted the trade from solar to nuclear. Constellation Energy (CEG) and Vistra Corp (VST) are no longer trading as utilities; they are trading as AI infrastructure proxies. Per the latest Reuters energy dispatch, the colocation premium for nuclear-adjacent data centers has risen to 35 percent over standard retail power rates. This is not a trend; it is a structural necessity for the survival of large language model training. The capital expenditure of Microsoft and Google is being diverted from chips to transformers and copper, signaling a mid-cycle rotation that many retail traders have missed.

Dissecting the Q3 Earnings Variance

The early Q3 earnings results from the banking sector, specifically JPMorgan Chase (JPM) and Goldman Sachs (GS), reveal a divergence in consumer health. Credit card delinquency rates for the bottom two quartiles of earners reached 3.9 percent on October 10, the highest level since 2011. While the headline GDP remains positive, the internal mechanics show a bifurcated economy. Wealthy households are benefiting from 4 percent yields on cash, while lower-income cohorts are being crushed by the persistence of 7 dollar per gallon gas in coastal markets and rising insurance premiums.

| Ticker | Price (Oct 15) | P/E Ratio (FWD) | 6-Month Delta | Risk Rating |

|---|---|---|---|---|

| NVDA | $138.40 | 44.2 | +22% | High |

| VST | $122.15 | 18.4 | +88% | Moderate |

| PLTR | $41.20 | 92.1 | +45% | Extreme |

| JPM | $214.50 | 12.3 | +11% | Low |

| TLT | $89.30 | N/A | -9% | Moderate |

The Technical Breakdown of the Plantir Surge

Palantir (PLTR) has become the retail favorite of 2025, but the valuation metrics are detached from the fundamental cash flow. Trading at over 90 times forward earnings, the stock is priced for a 100 percent capture of the government AI sector. However, the Department of Defense’s recent pivot toward multi-vendor contracts suggests that Palantir’s moat is narrower than the market believes. The technical support at 38 dollars is the only thing preventing a massive liquidation event. If the 10-Year yield touches 4.5 percent, the duration risk in stocks like PLTR will trigger automated sell programs across major quant funds.

Institutional flow data from the SEC’s latest 13F filings indicates a quiet exit from high-beta tech into defensive healthcare and utilities. This rotation is being masked by the S&P 500’s market-cap weighting, which over-represents a handful of tech giants. Smart money is not buying the dip; they are selling the rips into retail liquidity. The next major inflection point is the January 28, 2026, FOMC meeting, where the dot plot will likely reveal if the Fed’s terminal rate will settle significantly higher than the 2.5 percent neutral rate previously projected. Watch the 2-year yield closely; a move above 4.1 percent before year-end will invalidate the soft landing thesis entirely.