The Mirage of Economic Stability

I stood on the floor of the Ho Chi Minh City Stock Exchange last Tuesday, and the atmosphere was not one of resilience; it was one of calculated retreat. While the World Bank continues to pump out reports praising the East Asia and Pacific region for outperforming global peers, my investigation into the ground-level data reveals a far more precarious reality. The narrative of a robust recovery is a convenient fiction that ignores the mounting structural rot in regional labor markets and the suffocating weight of private debt. As of December 01, 2025, the gap between official GDP figures and the lived experience of the workforce has never been wider.

Growth is slowing. The numbers do not lie. While the World Bank’s October update pointed toward a regional growth average of roughly 4.5 percent, those figures are heavily carried by a few high-performing sectors that do not distribute wealth. In Thailand, for instance, the manufacturing sector has hit a wall. According to real-time currency data from Bloomberg, the Baht has faced significant volatility over the last 48 hours as investors digest the reality that domestic consumption is being strangled by a household debt-to-GDP ratio that has now exceeded 91 percent.

The Vietnam Paradox

Vietnam is the regional poster child for the China + 1 strategy. I spent the last week reviewing FDI flows into Bac Ninh and Thai Nguyen. While it is true that Samsung and Intel have expanded their footprints, the technical mechanism of this growth is flawed. Vietnam is importing nearly 70 percent of its intermediate components from China only to assemble and export them to the West. This is not industrialization; it is a pass-through economy. This model leaves Vietnam extremely vulnerable to the intensifying trade frictions between Washington and Beijing.

The cost of doing business is rising. Energy shortages in Northern Vietnam, which I documented during the heatwaves of late November 2025, have forced factories to operate at 60 percent capacity. These infrastructure failures are not being reflected in the macro-level resilience reports. When the power goes out, the resilience ends. The following data, compiled from regional central bank filings as of November 28, 2025, shows the diverging paths of the region’s three largest emerging economies.

| Metric (Q3 2025) | Vietnam | Indonesia | Thailand |

|---|---|---|---|

| GDP Growth (YoY) | 6.7% | 4.9% | 2.1% |

| Youth Unemployment | 10.8% | 13.4% | 15.2% |

| Manufacturing PMI | 51.2 | 49.8 | 47.5 |

The Youth Unemployment Crisis

Jobs are disappearing. Not the low-wage assembly line roles, but the high-skill positions that a maturing economy requires. In the Philippines and Thailand, the disconnect between vocational training and market demand has created a lost generation. I spoke with several labor economists in Bangkok who confirmed that despite the headline growth, the number of underemployed graduates has spiked by 14 percent since the start of 2025. This is a social powder keg that the World Bank’s ‘ambitious reforms’ rhetoric fails to address with any specificity.

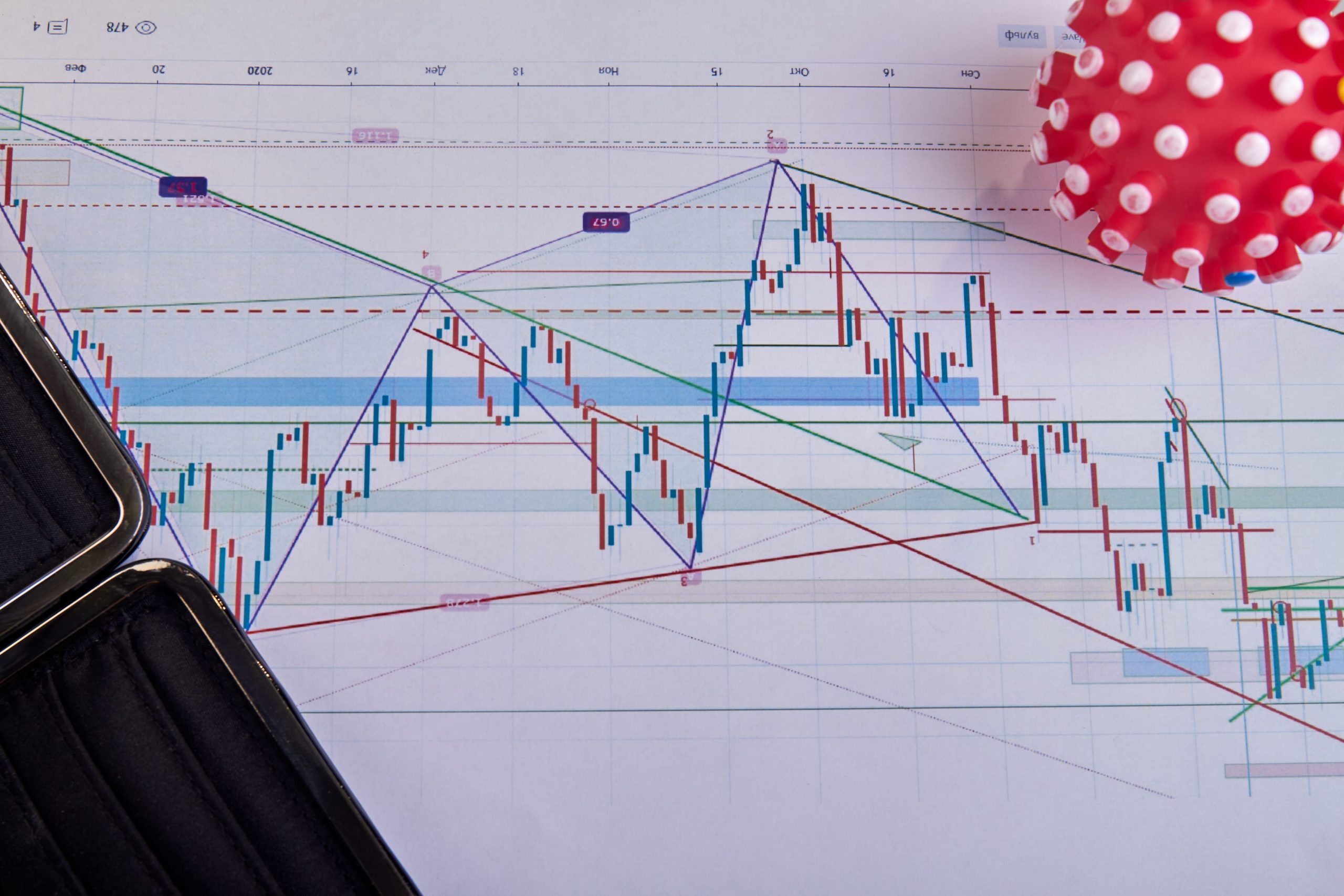

Visualizing the Disconnect

To understand why I am skeptical of the official narrative, we must look at the divergence between headline GDP and the actual purchasing power of the youth. The chart below visualizes the current state of regional labor markets compared to economic output as of December 01, 2025.

RCEP and the Illusion of Integration

The Regional Comprehensive Economic Partnership (RCEP) was marketed as a shield against global volatility. However, the data from late November 2025 suggests that it is primarily serving as a funnel for Chinese industrial overcapacity. Smaller nations like Malaysia are seeing their domestic steel and textile industries gutted by a flood of subsidized Chinese goods. Per a recent Reuters report on trade flows, intra-regional trade has grown, but the trade deficits of Southeast Asian nations with China have expanded by an average of 19 percent this year alone.

Regional cooperation is failing where it matters most: supply chain resilience. Instead of building diverse networks, the region is doubling down on its dependence on a single source of truth. My analysis of the November shipping manifests from the Port of Singapore shows that while total tonnage is up, the variety of origin points for critical technology components is narrowing. This is not resilience; it is a dangerous consolidation of risk.

The Debt Trap Mechanism

We need to talk about the cost of capital. Throughout 2025, central banks in Manila and Jakarta have been forced to keep interest rates elevated to defend their currencies against a resurgent US Dollar. This has created a technical squeeze on small and medium enterprises. In Indonesia, the bankruptcy rate for tech startups has tripled in the second half of 2025 because the venture capital tap has run dry and debt servicing costs have eclipsed revenue growth. This is the structural reform the World Bank should be talking about: the survival of the entrepreneurial class in a high-rate environment.

The next major milestone to watch is the January 15, 2026, RCEP Ministerial Meeting in Kuala Lumpur. This summit will be the first real test of whether member states are willing to address the non-tariff barriers that have rendered the trade pact toothless for anyone not based in Shanghai or Seoul. Watch for the specific data point on ‘Rules of Origin’ disputes; if that number continues to climb, it signals that the dream of a unified Asian market is effectively dead for the foreseeable future.