Monetary Policy Disconnect in the Post Election Landscape

The global currency markets are currently grappling with a fundamental mispricing of risk. On November 4, 2025, the Federal Reserve delivered a 25 basis point cut, lowering the benchmark funds rate to a range of 3.75 percent to 4.00 percent. While this move was mathematically expected, the market reaction has been anything but conventional. Instead of a softening greenback, we are witnessing a reinforced dollar dominance that defies traditional interest rate parity models. This resurgence is not merely a technical bounce; it is a structural response to the perceived fiscal trajectory of the second Trump administration and the sudden resolution of the six week government shutdown that had previously paralyzed federal data agencies.

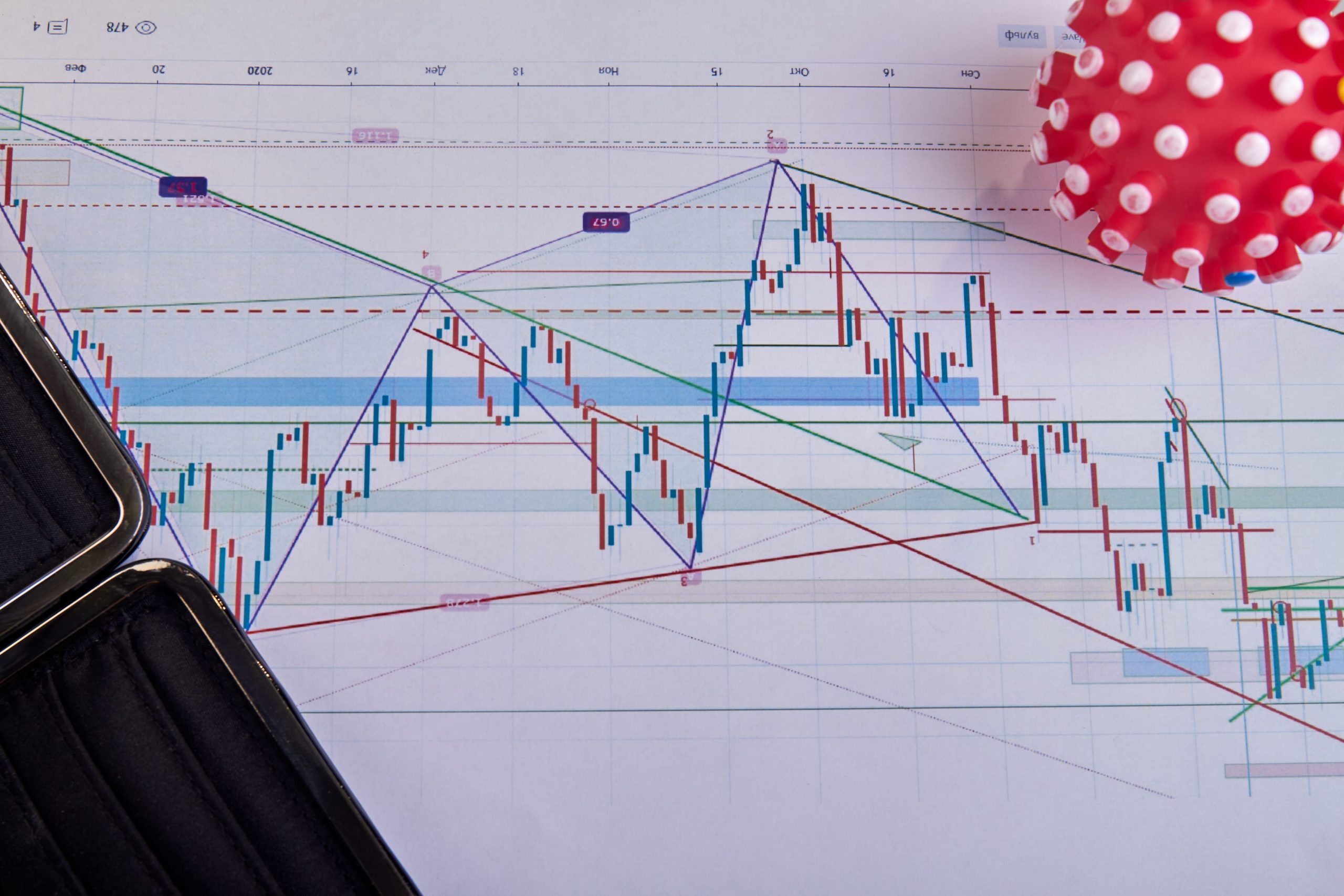

As of November 7, 2025, the U.S. Dollar Index (DXY) has appreciated by 1.2 percent over the last thirty days. This strength persists despite the fact that the index remains down roughly 7.7 percent on a calendar year-to-date basis. The paradox lies in the bond market. While Jerome Powell attempts to ease the front end of the curve, long term yields are staging a rebellion. Per reports on the November FOMC decision, internal dissent within the Federal Reserve is reaching a fever pitch. New Governor Stephen Miran, a known fiscal hawk, has reportedly pushed for even more aggressive action, while other members remain terrified of an inflation floor that refuses to drop below 3 percent.

The Yield Curve Rebellion

The 10-year Treasury yield is currently the most important number in global finance. On Friday, November 7, the yield finished at 4.11 percent, holding steady despite the Fed’s attempts to drive borrowing costs lower. This stagnation at the long end of the curve suggests that bond vigilantes are pricing in a massive fiscal expansion. With the recent election outcome, the market is front-running a regime of universal tariffs and significant deficit spending. This is the Term Premium returning with a vengeance. Investors are no longer willing to hold long dated U.S. debt without a significant risk buffer, creating a high-yield floor that keeps the dollar attractive to global capital flows.

According to Treasury yield data from early November, the spread between the 2-year and 10-year note has stabilized in positive territory, signaling that the recession fears of 2024 have been replaced by a fear of structural stagflation. The 30-year bond ending at 4.70 percent further illustrates this long term anxiety. For foreign exchange traders, this means the U.S. is offering a real-yield advantage that the Eurozone and Japan simply cannot match. The carry trade, once thought dead, is being resuscitated by the sheer force of U.S. fiscal exceptionalism.

Global Divergence: The Euro’s Consolidation and the Yen’s Abyss

Across the Atlantic, the European Central Bank (ECB) remains trapped. With third quarter GDP growth limping at 0.2 percent and inflation ticking back toward 2.2 percent, Christine Lagarde has little room to maneuver. The Euro is currently consolidating at 1.1548 against the dollar, but the technical pressure is building for a move toward parity. The policy divergence is stark; while the Fed manages a robust economy, the ECB is managing a stagnation crisis. The German industrial complex is still reeling from the energy shocks of previous years, and the threat of new U.S. tariffs on automobiles has effectively capped any Euro rally.

In Asia, the Japanese Yen is once again testing the resolve of the Ministry of Finance. As of November 7, USD/JPY is trading near 152.97. The Bank of Japan’s hesitation to normalize rates above 0.5 percent has turned the Yen into the ultimate funding currency for the U.S. yield advantage. Market participants are watching for verbal intervention, but without a significant shift in the BoJ’s hawkish rhetoric, the path of least resistance remains a weaker Yen. The following table highlights the current cross-currency landscape as of the close of business on November 7, 2025.

| Currency Pair / Security | Market Rate (Nov 07, 2025) | Monthly Change (%) |

|---|---|---|

| EUR/USD | 1.1548 | -1.1% |

| USD/JPY | 152.97 | +1.4% |

| GBP/USD | 1.3140 | -0.8% |

| US 10-Year Yield | 4.11% | +1.6% (bps change) |

| DXY Index | 105.40 | +1.2% |

The Mechanism of the Tariff Trade

The technical mechanism driving the dollar’s resurgence is the anticipation of the 2026 trade agenda. Tariffs are, by their nature, inflationary and dollar positive. When the U.S. imposes a tariff, it forces an adjustment in the terms of trade that usually results in a stronger domestic currency to offset the cost of imports. This creates a feedback loop where the dollar strengthens in anticipation of the policy, which then forces foreign central banks to maintain higher rates to prevent their own currencies from collapsing, further suppressing global growth compared to the U.S. energy and tech-insulated economy.

Furthermore, the resolution of the government shutdown has released a backlog of economic data that confirms the U.S. consumer is still spending. Retail sales figures and Non-Farm Payrolls, though slightly cooling, do not reflect a recessionary environment. This gives the Federal Reserve a green light to pause their cutting cycle in December if inflation data remains sticky. Per November FX outlooks, the likelihood of a December cut has dropped from 89 percent to just 64 percent in the last forty eight hours. If the Fed pauses in December, the dollar’s ascent will likely accelerate as the global carry trade rushes back into the greenback.

The focus now shifts to the final FOMC meeting of the year and the formal appointment of the next Treasury Secretary. Market participants are specifically looking for a candidate who will prioritize fiscal discipline or one who will facilitate the aggressive tariff regime promised on the campaign trail. The next major milestone for the currency markets will be the January 2026 inauguration and the subsequent USMCA review, which is expected to inject significant volatility into North American trade pairs. For now, the dollar remains the only game in town, anchored by a 4.11 percent yield that refuses to budge.