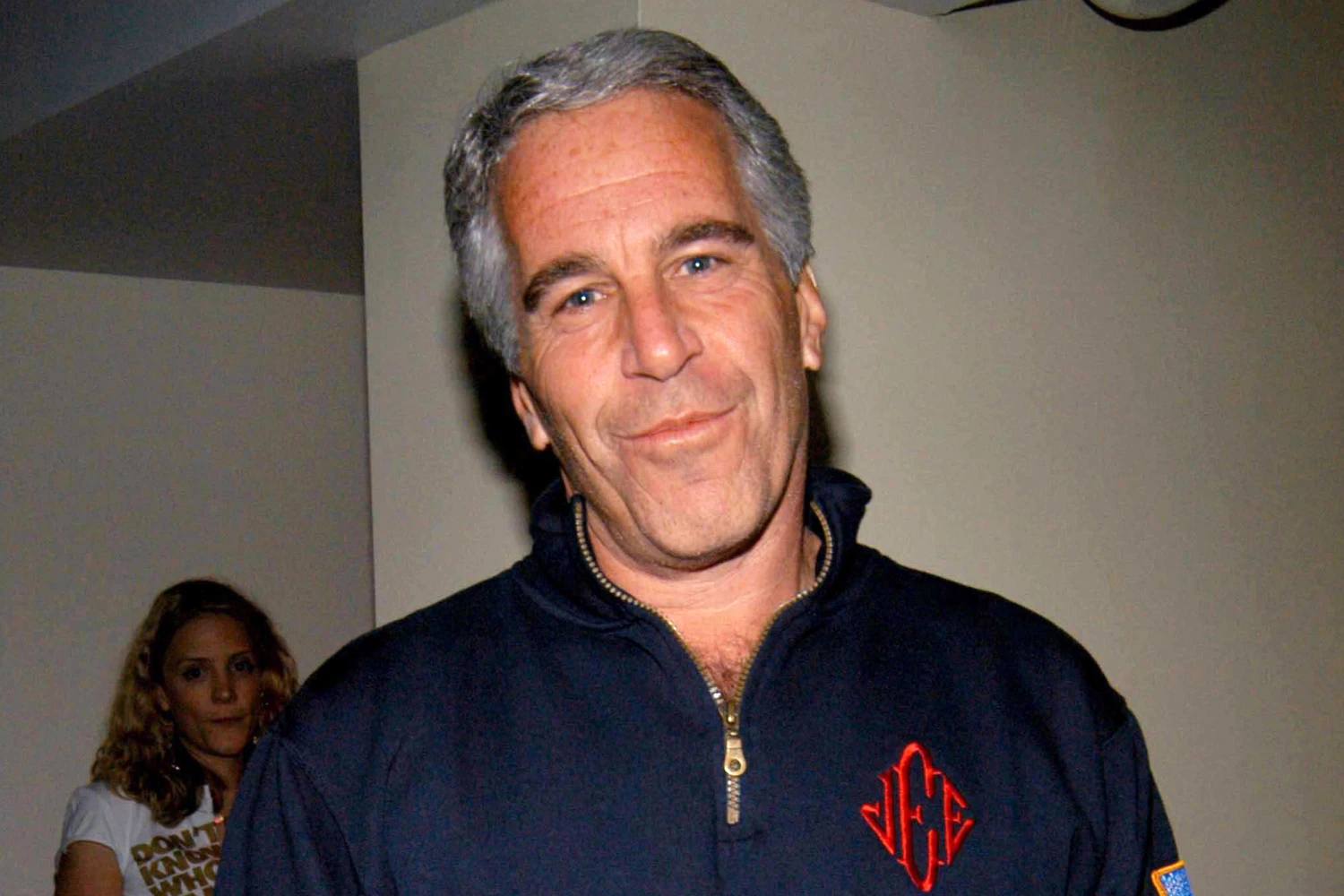

The money moved in silence. For decades, Leslie Wexner sat atop a retail empire that defined the American mall. Now, the silence breaks. Tomorrow, February 18, the House Oversight Committee will question the founder of L Brands. The subject is his long, opaque relationship with Jeffrey Epstein. This is not merely a social scandal. It is a forensic examination of institutional failure. The committee wants to know how a convicted sex offender gained total control over a billionaire’s fortune.

The Architecture of an Unregulated Family Office

Power of attorney is a dangerous instrument. In 1991, Wexner granted Epstein full authority over his legal and financial affairs. This was not a standard advisory role. It was a total abdication of oversight. Epstein could sign checks. He could buy and sell property. He could hire and fire staff. The House Oversight Committee is focusing on the flow of funds through the Wexner family office. They are looking for the mechanism of the transfer. They want to see the ledgers.

Retail empires are built on brand equity. Victoria’s Secret was the jewel in Wexner’s crown. Yet, while the brand projected an image of glamour, its financial plumbing was being managed by a man with no formal banking credentials. The retail sector has long ignored the risks of the ‘imperial CEO’ model. Wexner operated with little interference from a hand-picked board. This lack of friction allowed Epstein to embed himself in the Wexner ecosystem. The committee’s investigation suggests that the relationship was not just personal. It was structural.

Institutional Risk and the Retail Sector

Retail Sector Volatility Index: February 10 to February 17

Market volatility is rising. Investors are pricing in the risk of reputational contagion. The chart above illustrates the spike in retail sector volatility as the hearing date approached. This is a direct response to the uncertainty surrounding Wexner’s testimony. If the committee uncovers evidence of corporate funds being diverted to Epstein, the legal liabilities could be staggering. Shareholders are watching the Bloomberg terminal for any signs of a broader sell-off in the consumer discretionary space.

Transparency is the enemy of the private office. For years, Wexner’s financial dealings were shielded by a web of trusts and shell companies. The 1991 transfer of a New York City townhouse to Epstein is a primary point of interest. The property, valued at tens of millions, changed hands for a nominal sum. Tax authorities are now questioning the gift tax implications of such a transaction. The House Oversight Committee is using this as a case study in how the ultra-wealthy bypass standard financial reporting.

The Paper Trail of the Wexner-Epstein Nexus

| Asset/Entity | Estimated Value | Year of Transfer | Primary Concern |

|---|---|---|---|

| Manhattan Townhouse | $77 Million | 1991 | Gift Tax Evasion |

| Ohio Estate Land | $10 Million | 1998 | Zoning Influence |

| L Brands Shares | Undisclosed | 2003-2007 | Liquidity Transfers |

| Financial Power of Attorney | Unlimited | 1991-2007 | Fiduciary Negligence |

The table above outlines the key assets under scrutiny. These are not just numbers on a page. They represent a massive transfer of wealth without the typical oversight of a public company. Wexner has previously claimed he was ‘defrauded’ by Epstein. The committee is skeptical. They are looking for evidence of ‘knowing participation.’ If Epstein was acting as a fixer rather than a manager, the legal definition of their relationship changes. This could open Wexner to civil litigation from victims who claim his financial support enabled Epstein’s activities.

The Subpoena and the Strategy

Subpoenas are not suggestions. Wexner’s appearance tomorrow is the result of months of legal maneuvering. The committee is chaired by lawmakers who have made financial transparency a cornerstone of their platform. They are not interested in the salacious details of Epstein’s crimes. They are interested in the money. They want to know if L Brands’ resources were used to facilitate Epstein’s travel, housing, or recruitment of victims. This is a hunt for corporate malfeasance.

Corporate governance is the focus. The SEC has long required disclosures regarding ‘related party transactions.’ If Wexner was using corporate assets to benefit Epstein, and those transactions were not disclosed in SEC filings, it constitutes a violation of federal law. The ‘imperial CEO’ model is being put on trial. The committee wants to set a precedent that no founder is above the requirement for transparency, regardless of their success in the market.

Private equity and family offices are the next frontier. The Wexner investigation is a signal to the entire financial industry. The days of opaque, multi-billion dollar family offices operating without regulatory oversight are ending. The House Oversight Committee is using this hearing to build a case for the ‘Family Office Transparency Act.’ This proposed legislation would require any entity managing over $1 billion to register with the SEC and provide annual audits. Wexner is the catalyst for a much larger regulatory shift.

Institutional investors are already distancing themselves. Large pension funds have begun auditing their portfolios for any exposure to companies with similar ‘founder-controlled’ structures. The risk is no longer just financial. It is moral and reputational. The Wexner testimony will provide a roadmap for how these investigations will proceed in the future. It is a warning to every billionaire who thinks their private dealings can remain private forever.

The hearing begins at 10:00 AM. Wexner will likely rely on a strategy of ‘limited memory.’ However, the committee has the bank records. They have the emails. They have the property deeds. The discrepancy between Wexner’s testimony and the physical evidence will be the defining moment of the day. Watch the 10-Q filings for Bath & Body Works. The market is waiting for a reason to sell. The next data point to watch is the committee’s final report, expected in late March, which will likely recommend new SEC reporting requirements for private wealth managers.