The silver market is breaking. This is not a speculative fever dream. It is a structural realignment of a metal that has been undervalued for a generation. For years, silver was the forgotten stepchild of the precious metals complex. It was too industrial to be money and too cheap to be an investment. That era ended this week. As of January 30, 2026, the narrative has shifted from ‘if’ silver will reprice to ‘how high’ the floor actually sits.

The Industrial Vacuum

Industrial demand is cannibalizing the silver market. The green energy transition is no longer a policy goal. It is a physical reality. Photovoltaic manufacturers are consuming silver at a rate that exceeds mining output. In 2025, solar installations surged across the Global South. Silver is the primary conductor in these cells. There is no viable substitute. According to recent Reuters commodity reports, the supply deficit has widened for the fourth consecutive year. The physical market is tight. COMEX inventories are hovering at multi-year lows. This is the definition of a supply-side squeeze.

Mining production cannot keep up. Most silver is a byproduct of lead, zinc, and copper mining. You cannot simply flip a switch to produce more silver. You have to dig more base metals first. But base metal demand is cooling as global manufacturing slows. This creates a paradox. High demand for silver meets stagnant production. The result is a price floor that keeps moving higher. The current price action is not a peak. It is a mid-cycle correction.

Silver Demand Breakdown by Sector

To understand the repricing, one must look at where the metal is going. The following table illustrates the shift in demand over the last twelve months.

| Sector | 2025 Demand (Moz) | Jan 2026 Est. (Moz) | Growth Rate |

|---|---|---|---|

| Photovoltaics | 195 | 235 | 20.5% |

| Electronics | 260 | 275 | 5.7% |

| Investment (Coins/Bars) | 310 | 345 | 11.2% |

| Jewelry/Silverware | 215 | 205 | -4.6% |

Jewelry demand is falling. This is a classic signal. When prices rise, discretionary consumption drops. But industrial and investment demand are picking up the slack. Investors are finally treating silver as a monetary hedge. They are fleeing the volatility of fiat currencies. They are seeking the safety of hard assets. This is the monetary ghost returning to the machine.

The Ratio Compression

The Gold-to-Silver ratio is the ultimate indicator of silver’s value. Historically, this ratio has fluctuated wildly. In the modern era, it often sits above 80 to 1. This means it takes 80 ounces of silver to buy one ounce of gold. That ratio is unsustainable in a high-inflation environment. We are seeing a rapid compression. Silver is outperforming gold on a percentage basis. This is typical of the middle stage of a bull market. The ratio is currently diving toward the 70 to 1 level. Some analysts at Bloomberg suggest a move to 60 to 1 is imminent.

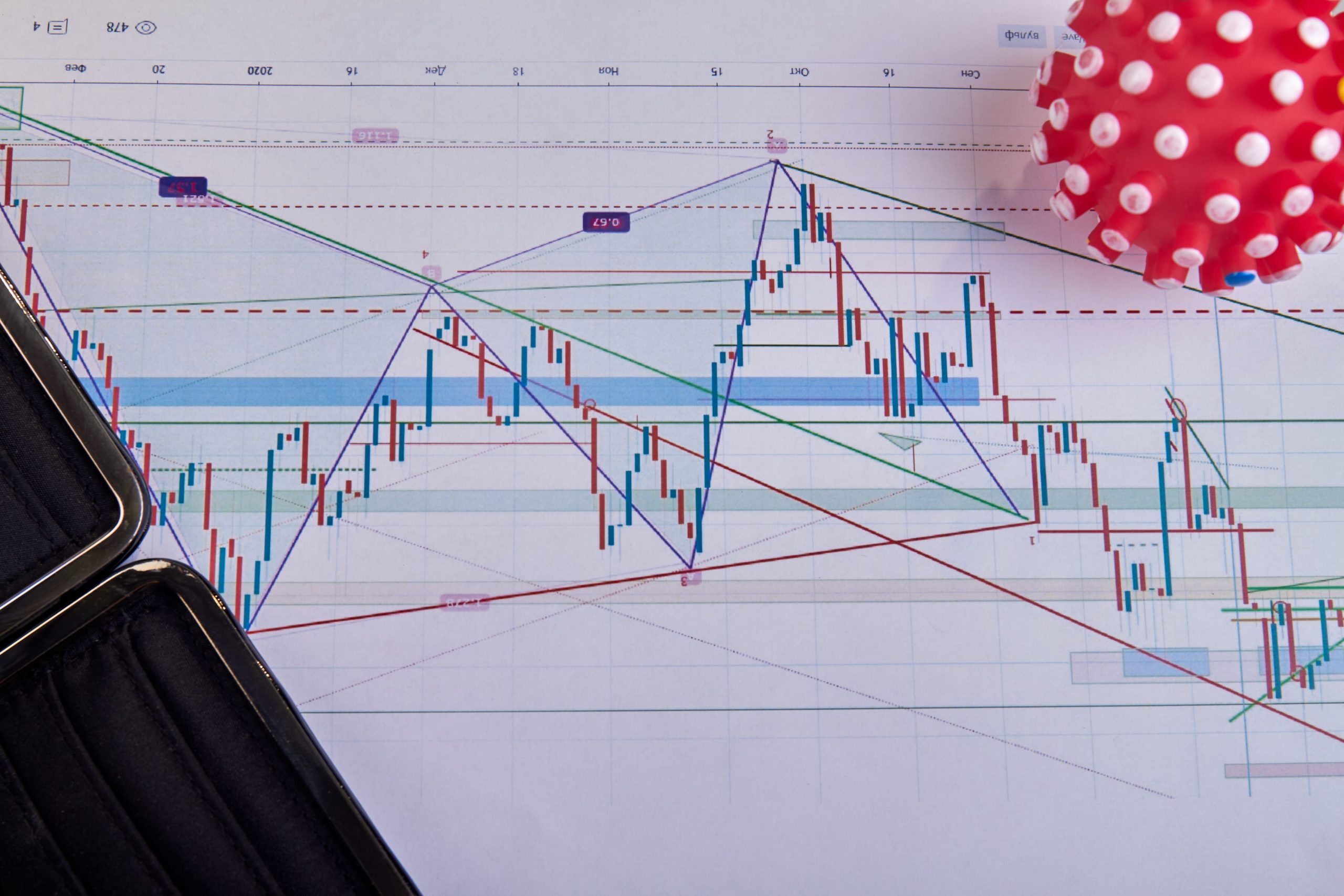

Gold to Silver Ratio Compression (LTM)

The chart above shows the steady decline of the ratio. This is not a fluke. It is a fundamental revaluation. When gold moves, silver follows with a lag. But when silver catches up, it does so with violence. We are in the violent phase. The ETFs like $SLV and $PSLV are seeing massive inflows. Institutional money is finally rotating out of overvalued tech stocks and into physical commodities. This rotation is just starting.

The Paper Market Mirage

The futures market is a lie. For years, the price of silver has been dictated by paper contracts on the COMEX. These contracts represent silver that does not exist in physical form. The ratio of paper silver to physical silver is staggering. But the paper market only works when no one asks for delivery. That is changing. Large buyers are now demanding physical settlement. They want the metal in their vaults. They do not want a promise on a screen.

This is the ‘repricing’ that the market is talking about. It is the transition from a paper-based price to a physical-based price. When the physical market takes over, the price discovery process changes. The ‘shorts’ are in trouble. They are trapped in a market with no liquidity and rising demand. They must buy back their positions at any price. This creates a feedback loop. Higher prices lead to more short covering, which leads to even higher prices.

Critics point to the volatility of silver. They say it is too risky. They are missing the point. Volatility is the price of admission for a generational asset move. Silver is correcting for forty years of stagnation. The repricing is a return to reality. It is a recognition that silver is a finite, essential resource in an increasingly electrified world. The monetary premium is just the icing on the cake.

Watch the $38 level closely in the coming weeks. If silver breaks and holds above this resistance, the path to the all-time highs of $50 becomes a matter of when, not if. The next data point to monitor is the February 15 COMEX delivery report. If delivery requests continue to outpace inventory arrivals, the repricing will accelerate into a full-scale scramble for physical metal.