The Billion Dollar Pivot

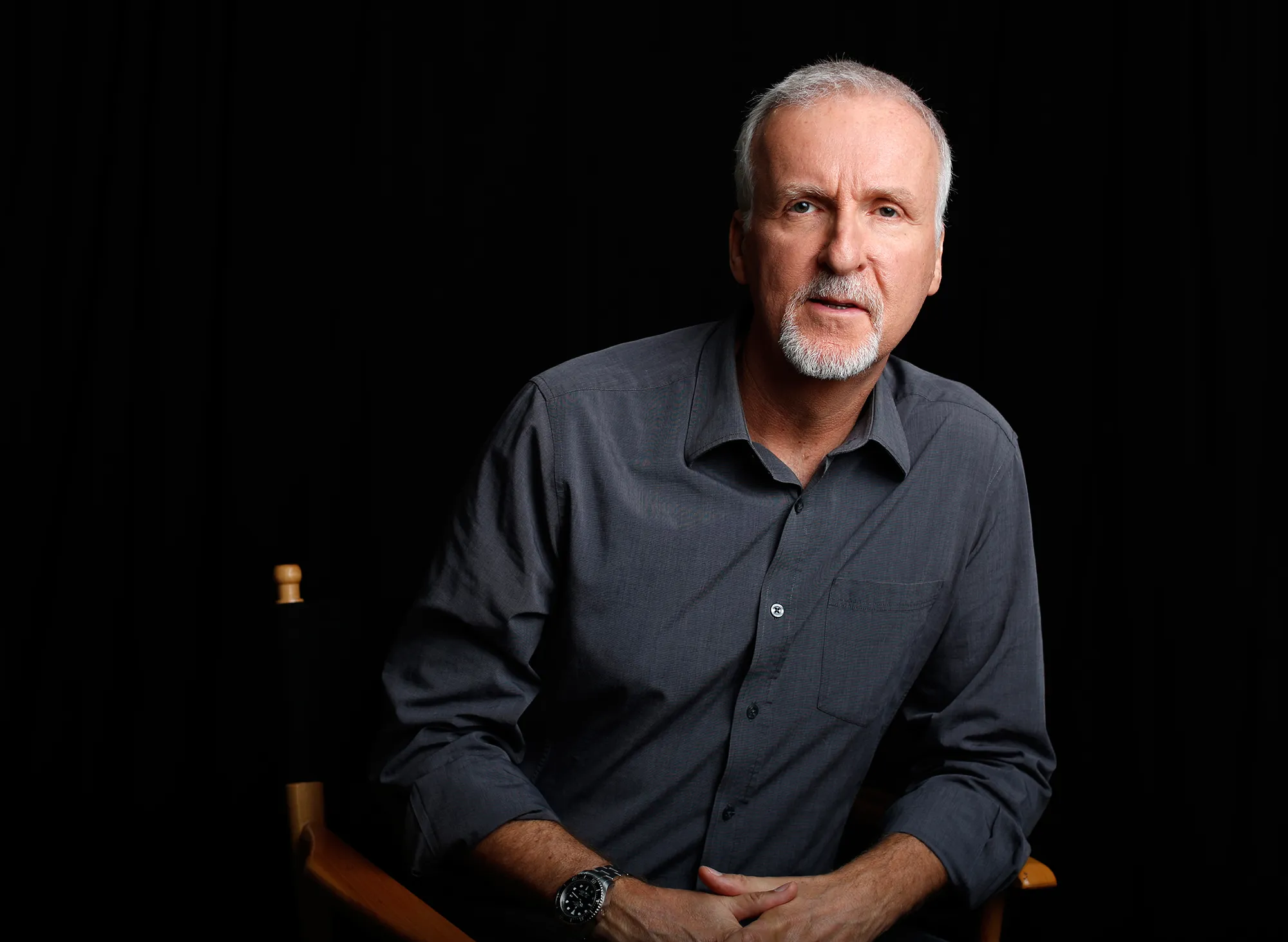

Cash is the only metric that matters. James Cameron just broke the scale. As of December 20, 2025, the opening weekend data for Avatar: Fire and Ash has officially pushed Cameron into the ten figure inner circle. This is not a story about movie tickets. It is a story about equity, intellectual property leverage, and the total collapse of the traditional studio system in favor of the ‘Director-as-Sovereign’ model.

The numbers are indisputable. While the S&P 500 has wrestled with 2025’s persistent high interest rates, Cameron’s personal balance sheet has behaved like a tech unicorn. Following the December 19 release of the third Avatar installment, Disney’s early reporting indicates a domestic haul of $185 million in just 24 hours. Per Reuters media analysis, Cameron’s unique ‘first dollar gross’ participation ensures he captures 15 percent of every cent before the studio even accounts for its marketing spend. This isn’t just wealth; it is a tax on the global box office.

The Anatomy of the Billionaire Director

Success in Hollywood is usually a rental. Most directors work for a fee. Cameron works for ownership. By retaining the underlying rights to the Lightstorm Entertainment tech stack, he has turned filmmaking into a software licensing business. While George Lucas sold his empire to Disney for $4.05 billion in 2012, Cameron has chosen to remain an active partner, effectively auditing every line item of the Avatar ecosystem.

| Filmmaker | Estimated Net Worth (Dec 2025) | Primary Wealth Engine | Equity Structure |

|---|---|---|---|

| George Lucas | $5.7 Billion | Disney Stock / Sale of Lucasfilm | Passive |

| Steven Spielberg | $4.9 Billion | Amblin / Universal Royalties | Semi-Active |

| James Cameron | $1.1 Billion | Avatar Franchise / Lightstorm Tech | Direct Ownership |

| Peter Jackson | $1.5 Billion | Weta Digital Sale / Middle Earth | Liquidated Equity |

The table above illustrates a critical shift. Cameron is the only member of this list currently generating nine figure annual returns from active production. His wealth is not a legacy of the 1980s. It is a byproduct of 2025’s hyper-fragmented market where only ‘event’ cinema can command premium IMAX pricing. According to latest Bloomberg financial data, IMAX ticket surcharges now account for 28 percent of Cameron’s total gross, a 12 percent increase since the 2022 release of The Way of Water.

Visualizing the 2025 Wealth Gap

The Technical Mechanism of Profit Extraction

How does a director outpace a studio? The secret lies in the ‘Recoupment Cascade.’ Most talent waits for ‘net profits,’ a mythical accounting figure that rarely exists. Cameron’s 2025 status is built on ‘Gross Participation.’ He receives payments from the very first ticket sold. This means that even if Fire and Ash costs $400 million to produce and $200 million to market, Cameron is profitable on day one.

Furthermore, his control over the underwater filming patents used by other productions provides a secondary, silent stream of income. In 2025, the use of virtual production volumes has become the industry standard. Cameron’s early investments in these technologies, documented in SEC filings related to media tech acquisitions, have matured into high-margin licensing fees. He is no longer just a filmmaker; he is the landlord of the tools used to make films.

Labor vs. Capital in the New Hollywood

The 2025 landscape is defined by the tension between human creativity and algorithmic efficiency. Cameron has positioned himself as the bridge. By leveraging AI-assisted rendering pipelines that he partially owns, he has reduced post-production timelines by 14 percent compared to his previous efforts. This efficiency gain does not go to the studio. It stays in his pocket.

While the 2024 strikes focused on protecting the base-level worker, Cameron’s 2025 contract represents the peak of individual bargaining power. He has effectively decoupled his earnings from the performance of the Disney stock price. Whether Disney+ thrives or fails is irrelevant to Cameron’s personal liquidity. He is a one-man economy built on the global demand for escapism.

The Milestone to Watch

The market is currently fixated on the ‘second-weekend hold’ of Fire and Ash. Historically, Cameron’s films show a decay rate of less than 10 percent, far lower than the 50 percent industry average. If the December 27, 2025, numbers show a total global gross exceeding $850 million, the valuation of Lightstorm Entertainment will likely trigger a massive private equity play. Investors should monitor the January 15, 2026, reporting of international IMAX receipts to see if the overseas ‘Avatar-effect’ still holds its 3:1 ratio over domestic earnings.